Recently, we talked about the landmark accomplishment for Apple (AAPL) – hitting the $3 trillion valuation and actually holding it this time. And, there’s reason to believe Apple is well on its way to the next milestone – $4 trillion.

But, nipping close at Apple’s heels is another burgeoning tech stock – one that is potentially less than a year away from the $3 trillion valuation. And that’s Microsoft (MSFT). The same analyst that predicted Apple’s rise in valuation is saying that this tech company will do the same by early 2024 – which is less than six months away.

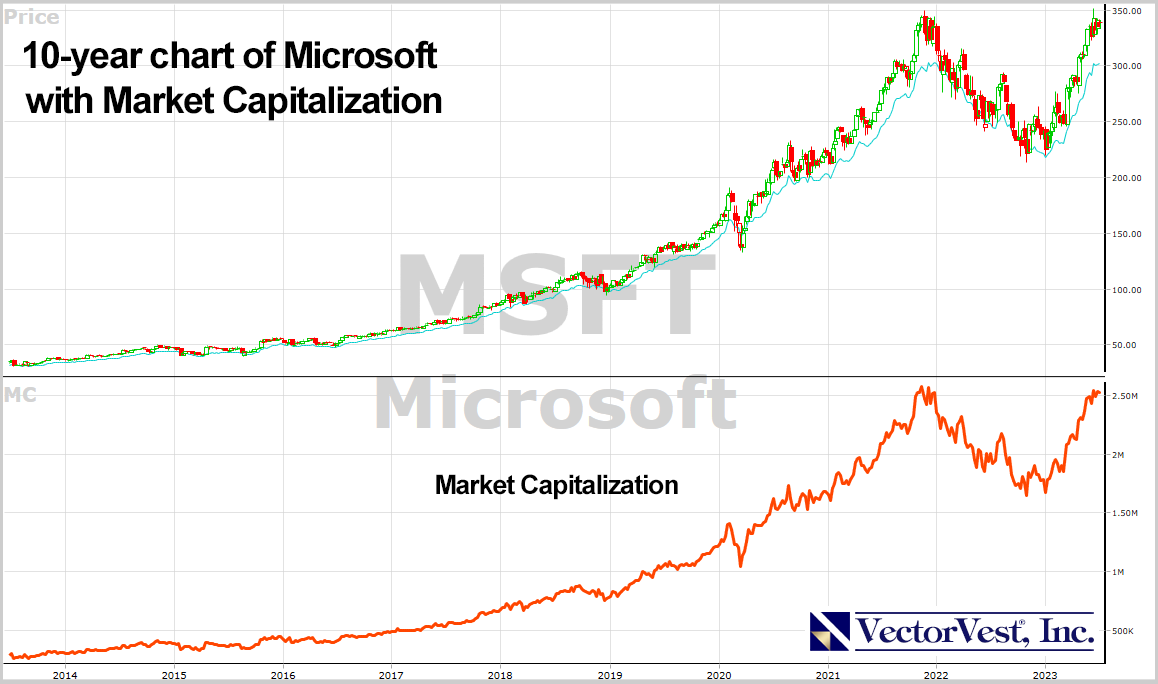

Dan Ives of Wedbush says that while Apple is in a class of its own, it’s important to recognize the impressive path Microsoft is on as well. The company currently has a market capitalization of just over $2.5 trillion, so it has a ways to go. So, what does Ives see that has him watching the stock so closely?

As with most tech discussions lately, it’s the AI craze. Ives says that for every $100 invested in Microsoft’s cloud Azure segment, there is up to $40 spent in AI. Not only does Microsoft own Bing – which is making waves with its AI browsing feature – but they also have backed numerous AI start-ups.

We last talked about Microsoft in April, when the company reported its fiscal 3rd quarter earnings. At that point, share prices were rising as revenue and profitability both jumped. But the stock sat at a price of just $305/share. Today, MSFT shares rest at nearly $340.

In the last year, the stock has climbed more than 32%. If Ives is correct in his estimation that Microsoft could be less than six months away from a $3 trillion valuation, that implies quite the upside. That being said, should you buy MSFT early and ride the wave to that landmark valuation?

We’re going to progress this conversation by pulling the curtain back on this stock and taking a look through the VectorVest stock forecasting software. We’ve got three things we want to show you to help you feel more confident and clear on your next move with MSFT.

MSFT Has Fair Upside Potential, Good Timing, and Very Good Safety

The VectorVest system simplifies your trading strategy through a proprietary stock rating algorithm. It gives you all the information you need to make calculated, emotionless decisions in the stock market with 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Interpreting these ratings is quick and easy as they sit on a simple scale of 0.00-2.00, with 1.00 being the average. But, to make things even easier, the system even issues a clear buy, sell, or hold recommendation for any given stock, at any given time. As for MSFT, here’s what we’ve uncovered…

- Fair Upside Potential: MSFT is currently trading at a 52-week high – meaning it’s fair to wonder how much more room for growth there is with this stock. Right now, the RV rating of 0.94 indicates fair upside potential – albeit below average. This rating is derived through a comparison of the stock’s 3-year price appreciation potential to AAA corporate bond rates and risk. That being said, the stock is currently overvalued, with a current value of just $203/share.

- Very Good Safety: In terms of risk, though, the stock has a very good RS rating of 1.38. This rating is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Good Timing: As you can see by looking at the current price trend for MSFT, the stock has good timing – and the RT rating of 1.13 reflects that. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.17 is good for MSFT – but is it enough to justify a buy? Or, is there reason to believe that the pace this stock has been on is going to slow down in the near future?

Don’t play the guessing game or let emotion influence your decision-making. Make your next move with complete clarity and confidence through a free stock analysis at Vectorvest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Ives believes MSFT is as close to 6 months away from a $3 trillion valuation – but right now, the upside potential for this stock is just fair according to VectorVest. That being said, the stock does have very good safety and good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment