Earlier this week, Walgreens (WBA) warned investors that profits would take a dive from previous estimates as a result of weakened consumer spending and dwindling demand for COVID-19 vaccinations. As a result, shares dropped more than 9% this week – now reaching their lowest levels in over a decade.

CEO Rosalind Brewer noted that while COVID was certain to be a wildcard for the year, it’s turning out to be less favorable than they had initially anticipated. For the fiscal third quarter that ended May 31, the company gave out 800k vaccines – down 83% from this time last year.

But, the end of the COVID pandemic isn’t the only hurdle companies like Walgreens are facing. All retailers are up against a challenging economic climate, where weakened consumer spending will affect revenues across seemingly all industries.

High interest rates and inflation have taken their toll on American spending, and Walgreens is feeling the effects. As a result, the company slashed its full-year outlook from an EPS of $4.45-$4.65 to just $4.00-$4.05.

That being said, the company did report revenue that exceeded analyst expectations for the quarter ended last month – 35.42 billion compared to $34.21 billion. However, that’s where the good news ends. Earnings fell short of expectations at $1.00 compared to the estimate of $1.06, and the gross margin of 18.8% disappointed compared to the consensus of 20.6%.

All that being said, WBA stock has been beaten down badly over the last year – weathering a nearly 30% drop in that span. And as we mentioned earlier, this is its lowest point since 2010. So, does this present a good buying opportunity for the stock to potentially rebound? Or, is this your sign to cut losses on WBA stock?

We’ve taken a look at the current opportunity through the VectorVest stock analysis software and want to help you make your next move with complete confidence and clarity. So, take a look below at these 3 key takeaways from our analysis…

Despite Fair Upside Potential, WBA Has Poor Safety and Timing

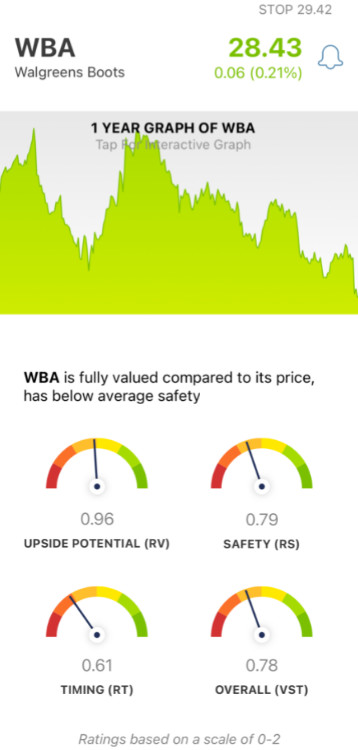

The VectorVest stock analysis software provides all the insights you need to feel confident in executing your trading strategy through 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on a simple scale of 0.00-2.00, with 1.00 being the average. And, based on the overall VST rating for a stock, the system even offers a clear buy, sell, or hold recommendation - reflecting real-time data. As for WBA, here is what we see holding this stock back right now:

- Fair Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential (projected 3 years out) and corporate bond rates & risk. As for WBA, it has a fair RV rating of 0.96 - just below the average. What’s more, we see that the stock is currently fully valued at its price of $28.45.

- Poor Safety: In terms of risk, though, WBA has poor safety - as evidenced by the RS rating of 0.79. This is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: Making matters worse, the stock has poor timing as well - with an RT rating of just 0.61. This indicates a fairly strong negative price trend has a hold of WBA right now. The rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.78 is poor for WBA. Does that mean it’s officially time to cut ties and sell off any shares you are holding? Or, is there any reason to continue weathering the storm? Get a clear answer on what you should do next through a free stock analysis at VectorVest today.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for WBA, the stock currently has fair upside potential - but that's where the good news ends. The stock is burdened by poor safety and timing amidst weakening consumer spending and dwindling COVID-vax demand.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment