Late last Friday, Tupperware (TUP) released a grave warning to shareholders about the company’s near future. The company has hired financial advisers to determine the best plan of action in the short term. As a result, the stock has slid more than 48% so far in Monday morning’s trading session.

The company is facing a multitude of challenges that have landed them in this spot. For one, sales are dropping steadily year over year. In 2022 alone, revenue tanked 18%.

This leads to the next issue, which is that the company isn’t even sure how much it lost. They’re in the process of restating prior financials after identifying a weakness in internal control over reporting. The 10-K they’re expected to file is already late, and investors won’t know the real situation until that documentation is released.

On top of all this, Tupperware is burdened by debt. Because of all this, the specific warning issued on Friday pointed out issues with liquidity in the near term. There’s no cash on hand, and there doesn’t appear to be a clear path forward on how to get more cash.

While the company does point to the economic headwinds the world as a whole is facing, it acknowledges that internal operations are to blame for many of these issues. They’ve made their bed, and now they have to lay in it.

More concerning, though, is that the business model which got Tupperware to where it is (direct selling) has gone out of style. Gone are the days of housewives throwing Tupperware parties or going door-to-door pitching products. And in considering the challenges with price competition between brands on Amazon, it appears as if the writing is on the wall for this company.

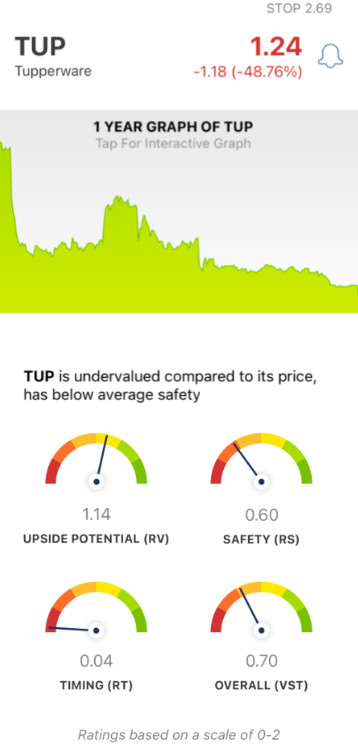

The stock has fallen off a cliff in the past year, down 93% as a result of this news. So – if you’re currently invested in Tupperware, is this the time to cut losses before it’s too late? We’ve identified 3 things you need to see through the VectorVest stock analyzing software below.

Despite Good Upside Potential, TUP Has Poor Safety & Very Poor Timing

The VectorVest system helps you simplify your trading strategy by giving you clear, actionable insights in just 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average. Interpretation is quick and easy - just pick stocks with appreciating ratings above the average to win more trades with less work!

Or, better yet, follow the clear buy, sell, or hold recommendation that VectorVest offers based on the overall rating for any given stock, at any given time. As for TUP, here’s what’s going on right now:

- Good Upside Potential: As the price for TUP sits at an all-time low, there’s at least some room for price appreciation potential - and the good RV rating of 1.14 reflects that. This rating is a comparison of the stock’s 3-year price projection in comparison to AAA corporate bond rates and risk. As of now, the stock is undervalued - with a current value of $3.56 a share.

- Poor Safety: In terms of risk, TUP is obviously not a safe stock right now - as confirmed by the RS rating of 0.60. This is based on the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Very Poor Timing: The biggest issue for TUP is the strong negative price trend that has taken a grip on the stock. The RT rating of 0.04 is about as poor as it gets. This is all based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating for TUP is poor at 0.70. So, is it time to cut losses on this stock - or is there any reason for investors to hold onto hope? Don’t let emotion or guesswork get the best of you. Get a clear answer on your next move with a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for TUP, it has good upside potential - but that’s the only positive takeaway. The safety for this stock is poor, and its timing is very poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment