Intel Corporation (INTC) has been losing its footing over the past month after the company announced a revision to its second-quarter earnings and revenue outlook.

The stock has fallen more than 27% since the start of August, adding to a more concerning long-term trend. INTC has lost nearly 60% of its value through 2024 thus far, dropping from just under $50/share to now just $20/share.

It wasn’t just disappointment on the earnings front putting downward pressure on the stock, though. Investors are worried about the long-term viability of Intel’s foundry business. They’re also not convinced the company can compete in the AI market the way its competitors are.

To make matters worse, one of the company’s most industry-seasoned board members stopped down just a few days ago. Lip-Bu Tan served for just 2 years and says this was purely a personal decision, and he still remains supportive of the work Intel is doing.

Tan left on his own terms, but 15,000 Intel employees did not. The company just implemented a major organizational change that led to widespread layoffs across the business.

Intel has just recently begun working with Morgan Stanley advisors as concerns mount on the activist investor front, too. While no campaign has officially been launched against Intel just yet, sources close to the company say it’s gearing up for a defense.

CEO Pat Gelsinger has his work cut out for him as INTC now sits at its lowest point since 2012. But just a month ago, we saw reasons to consider buying INTC as the stock had begun rallying in the right direction.

That is no longer the case today, though. It may be time to sell this stock – see 3 reasons why below in the VectorVest stock software.

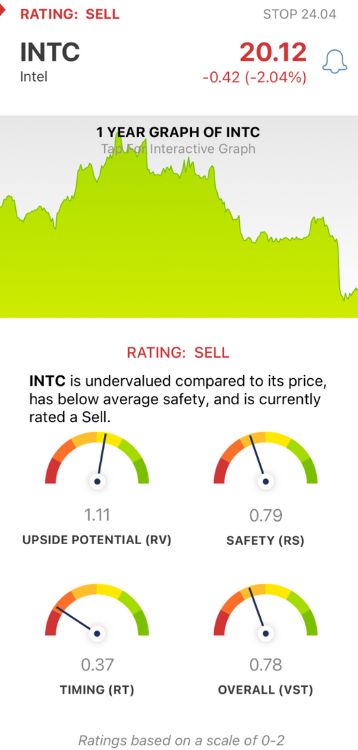

INTC Has Good Upside Potential, But Poor Safety and Very Poor Timing are Holding it Back

VectorVest is a proprietary stock rating system that has outperformed the S&P 500 index by 10x over the past 20 years and counting. It’s done this while simplifying stock analysis, delivering clear, actionable insights in just 3 ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

It gets even better, though. The system issues a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what you need to know about INTC:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator to the typical comparison of price to value alone. INTC has a good RV rating of 1.11. The stock is undervalued, with a current value of $24.17/share.

- Poor Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. INTC has a poor RS rating of 0.79.

- Very Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 0.37 is very poor for INTC, reflecting its performance over the past year or so.

The overall VST rating of 0.78 is poor for INTC, and the stock is in fact rated a SELL right now. If you’re currently holding this stock or are looking for more information, get a free stock analysis at VectorVest right now for the full scoop!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. INTC is down another 2% today, adding to the losses it’s faced in the past month and for the past year for that matter. There are a multitude of challenges the company is up against, and the stock itself has poor safety and very poor timing despite good upside potential.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment