Intel (INTC) gained more than 10% over the past week thanks to bullish coverage by one analyst at Melius Research who sees the stock as a top contender in the AI battlefield for the remainder of 2024.

Ben Reitzes is optimistic about Microsoft’s new Recall AI and what it could mean for Intel, particularly its devices that are equipped with the Lunar Lake central processing unit (CPU) line for PCs and mobile.

The Recall AI feature empowers users to trace back their computer’s data history to early on. While some suspect it’ll be here in 2025, others believe it could arrive as soon as this year.

That’s not the only thing pushing INTC higher either. The company is said to be preparing for the launch of a new graphics processing unit (GPU) known as the Battlemage processor.

It’ll be built by Taiwan Semiconductor Manufacturing, which is a company on its own upward trajectory as we discussed yesterday. Intel’s new PC processor will use a four-nanometer (4nm) node platform, which is especially appealing to gamers.

While it’s not going to get the AI boost that comes from products targeted at the data-center market, the pending launch (set for 2025) is still reason to be excited as this could represent a new segment for Intel.

The first half of 2024 was brutal for INTC investors who watched their positions plummet more than 30%. Even after this week’s rally, the stock is in the red. But does today’s price of $34/share represent a good value buy as the company fuels up for the second half of the year?

We’ve taken a closer look at INTC through the VectorVest stocks software and found a few reasons you may want to buy this stock today.

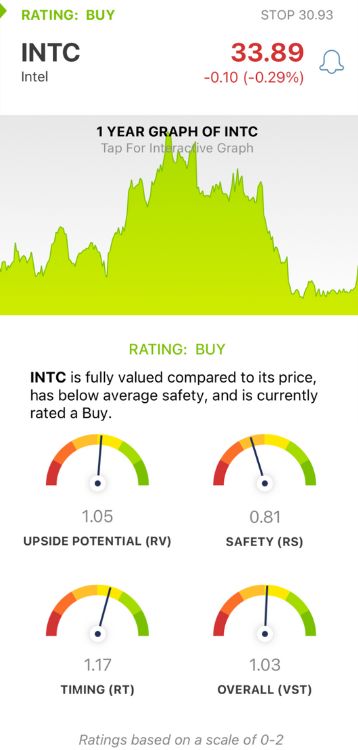

INTC Has Fair Upside Potential and Good Timing Despite Poor Safety

VectorVest saves you time and stress while helping you earn higher returns. It does this by giving you all the information you need to make calculated, emotionless decisions in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. Better yet, you’re given a buy, sell, or hold recommendation for any given stock at any given time. As for INTC, here’s what you need to see:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a far superior indicator than the typical comparison of price to value alone. INTC has an RV rating of 1.05 which is fair.

- Poor Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. INTC has a poor RS rating of 0.81.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. INTC has a good RT rating of 1.17.

The overall VST rating of 1.03 is just above the average and considered fair - but the stock itself is rated a BUY right now. Before you do anything else, look at this free stock analysis to fully capitalize on this opportunity and transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. INTC got an upgrade from an analyst with Melius Research who sees upside for the second half of this year thanks to AI growth and expansion into gaming GPUs. The stock itself has fair upside potential and good timing despite poor safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment