Humana Inc. (HUM) is down more than 14% in Thursday’s trading session, as the losses keep piling up for investors over the past few weeks. The managed care company cut its guidance for 2024 while we’re not even out of January yet.

Sky-high medical costs are taking a toll on the company, which has led to the decision to narrow its profit target by 7%, down from $16 per share to just $14.87 per share. According to FactSet, which is currently slated for $29.15, this is less than half of what analysts are forecasting.

This is coming off the 4th quarter in 2023 in which Humana reported a steep loss of $491 million – which comes out to $4.42 per share. The company lost just $71 million the year prior.

So, what happened? There was a dramatic increase in the utilization of Medicare Advantage inpatient services, particularly in the final months of the year.

The only positive takeaway from Q4 was a slight increase in revenue, up to $26.46 billion from $22.44 billion the previous year. The FactSet consensus called for $25.49 billion.

While the alarm bells may be sounding, experts suggest this is a cautious play by Humana that covers a worst-case scenario. Setting the bar so low this early in the year poises the stock to perform better than expected in the coming quarters, setting the stage for earning beats and guidance lifts.

It’s also important to note that Humana is working through the first year of a three-year ramp-up phase for Medicare Advantage coding adjustments. Growth for this segment is slower than expected thus far, but it’s likely that investors will remain patient and await 2025 earnings.

In the meantime, though, HUM has fallen more than 20% in the past month and 32% in the past 3 months. How much longer should investors weather the storm before cutting losses on this stock?

We’ve taken a look through the VectorVest stocks software and see 1 reason in particular to consider moving on from HUM today…

HUM May Have Very Good Upside Potential and Good Safety, But the Timing is Very Poor Right Now

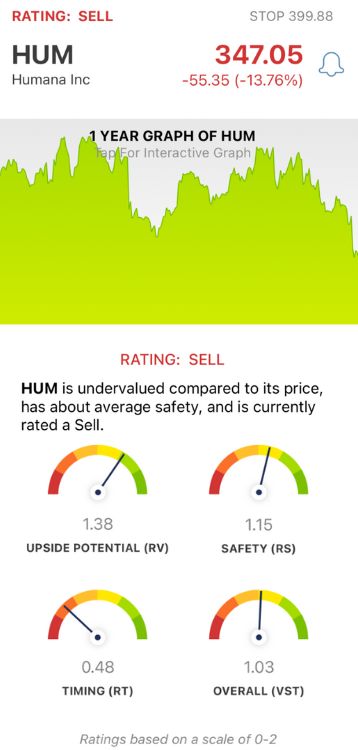

VectorVest’s proprietary stock rating system gives you all the insight you need to make clear, calculated investment decisions in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average. This makes integration quick and easy, but it gets even better. You’re given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating.

As for HUM, here’s what you need to know:

- Very Good Upside Potential: The RV rating is a comparison of a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers way better information than a standard comparison of price to value alone. HUM has a very good RV rating of 1.38 right now. Further to that point, the stock’s current value is $551.88 compared to a price of $346.

- Good Safety: The RS rating is a risk indicator. It’s calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.15 is good for HUM.

- Very good Timing: The big red flag comes down to timing, as HUM investors have been put through the wringer over the past few months. The RT rating of 0.48 is very poor. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.03 is just above the average and considered fair. However, VectorVest has placed a SELL recommendation on HUM for the time being. Learn more by getting a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. HUM is down more than 14% after cutting its guidance and issuing a warning of skyrocketing costs and slow growth. The stock still has very good upside potential and good safety, but its very poor timing means it's time to sell right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment