The wildfires in Maui are officially the most deadly in the US in the last century, claiming the lives of more than 110 people so far. People have already rushed to assign blame – citing blunders by the city’s emergency chief, the mayor, and now, Hawaiian Electric (HE).

Shares of the state’s energy provider have tanked more than 32% so far this week on concerns the company is liable for the fires. The S&P 500 downgraded the stock to junk status, and investors are in a frenzy to offload their shares.

The worry is that the fires were sparked by the company’s equipment. If it did play any role, Hawaiian Electric could be facing serious lawsuits.

We saw the very same thing a few years back when PG&E sparked wildfires in the small town of Paradise, California. The California energy provider ended up reaching a settlement of over $520 million dollars.

At the time, the Camp Fire (as it was called) would be the deadliest wildfire in our country’s history over the last century. But that unfortunate title now belongs to the devastated town of Lahaina in Maui.

Whether the company’s equipment can be traced back to the root cause or not remains to be seen. What we do know is that the company failed to shut off power lines even after warnings that high winds could knock the lines down.

This is exactly what caused the Camp Fire in Paradise in 2018. PG&E eventually had to file for bankruptcy and restructure. In the end, it’s the residents of Hawaii that lose. Not only is their home destroyed, but Hawaiian Electric will simply raise rates to offset the lawsuits as PG&E has in California.

The Vice President of the company declined to comment other than to say that they are cooperating in the investigation and the company does not have a formal “shut-off” program. Precautionary shut-offs are to be arranged with first responders.

It will likely be years before all of this is said and done. In the meantime, is it best to remove yourself from the situation altogether and get out of HE as a current investor? Or, is this an opportunity to buy into the stock as it sits at its lowest point in the last decade?

We’ve taken a look through the VectorVest stock forecasting software and have 3 things you should know before you do anything one way or the other.

Despite Excellent Upside Potential and Fair Safety, HE Has Very Poor Timing

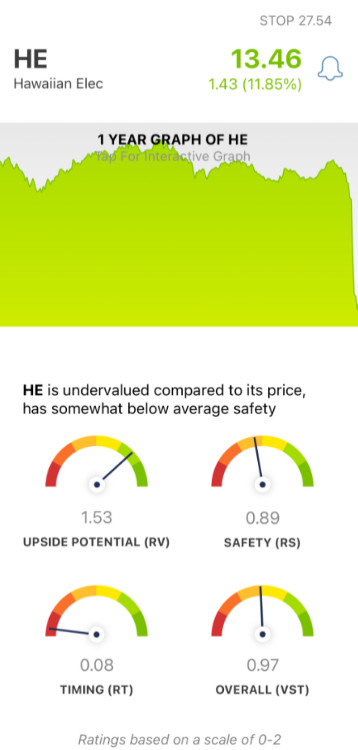

The VectorVest system simplifies your trading strategy by giving you all the information you need in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these proprietary ratings sits on its own scale of 0.00-2.00, with 1.00 being the average. This makes interpretation quick and easy. But it gets better.

Because based on the overall VST rating for a stock, the system issues a clear buy, sell, or hold recommendation for any given stock, at any given time. As for HE, here’s what we uncovered:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk, offering far better insights than a simple comparison of price to value alone. As for HE, the RV rating of 1.53 is excellent. With the recent sell-off, the stock is now undervalued - with a current value of $29.61.

- Fair Safety: In terms of risk, HE is a fairly safe stock - with an RS rating just below the average at 0.89. This rating is calculated by analyzing the company’s financial consistency and predictability, debt-to-equity ratio, and business longevity.

- Very Poor Timing: The real issue right now is the negative investor sentiment surrounding this stock. As a result of the Maui wildfires, this stock has tanked - and the RT rating of 0.08 is about as poor as it gets. The rating itself is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.97 is just slightly short of the average and is considered fair. So, where does that leave investors or prospective traders? Should you buy, sell, or hold HE?

A clear answer is just a click away - get a stock analysis free today and make your next move with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Although HE has excellent upside potential and fair safety, the stock has very poor timing as concerns of wildfire liability have scared away investors.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment