Shares of General Motors Co. (GM) are down more than 5% so far Wednesday morning, making for a 7% loss over the past month. This comes on the heels of a once-bullish analyst changing his stance on the stock, downgrading it from the equivalent of buy to hold.

Daniel Roeska with Bernstein moved his price target from $54.50 to $53. That still implies solid upside potential, but Roeska thinks the stock’s price has become inflated and a correction is in order.

The stock bottomed out at roughly $26 per share back in November of 2023 amidst the turmoil of a worker’s strike. The United Auto Workers union affected not just General Motors but also Ford Motor and Stellantis.

The strike ended and GM shot back up, gaining more than 40% in the past year. Even through 2024 thus far it’s up nearly 28%.

Not all of this improvement is merely the result of a strike ending, either. The auto manufacturer has worked relentlessly to drive better results and return value to shareholders. It bought back a whopping $16 billion worth of shares recently, which is almost unheard of for a business this big.

The company’s first and second quarterly earnings results topped analyst expectations, and it looks poised to do the same in Q3. It may even announce approval of more share repurchasing on its October 8th investor event.

However, Roeska is more cautious as the company is building up a surplus inventory for new vehicles, and pricing pressure is an issue as well.

General Motors also announced it would be laying off around 1,700 Kansas assembly plant workers, stirring unrest about the auto industry as a whole. The company was quick to quell those fears, though, saying it’s in the midst of revamping the facility to build the Chevy Bolt EV.

Still, GM has plenty of bulls behind it, with 60% of analysts maintaining a buy rating after Roeska’s change of narrative. We’ve taken a closer look at the situation ourselves in the VectorVest stock analysis software and found 3 things investors need to be aware of.

GM Still Has Excellent Upside Potential With Fair Safety and Timing

The VectorVest system saves you time and stress while empowering you to win more trades with less work. It does this by giving you all the insights you need to make clear, calculated investment decisions in 3 simple ratings.

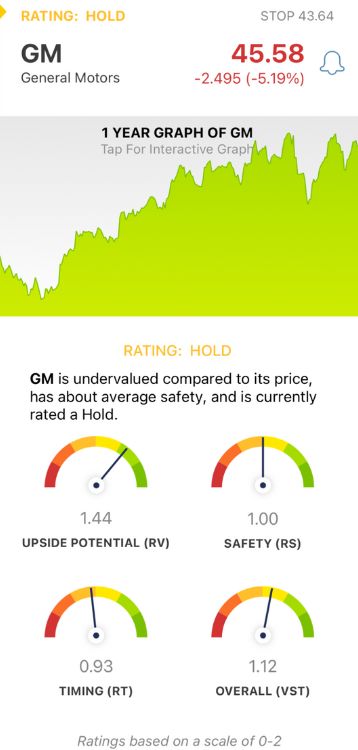

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

You’re even presented with a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating - including GM. Here’s what we uncovered:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a much better indicator than the typical comparison of price to value alone. GM still has an excellent RV rating of 1.44 even after its impressive gains over the last year. The stock is undervalued, with a current value of $69.03.

- Fair Safety: The RS rating is a risk indicator that’s derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. GM has a fair RS rating of 1.00, right at the average.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price trend. It’s calculated day over day, week over week, quarter over quarter, and year over year. GM has a fair RT rating of 0.93, just a bit below the average.

The overall VST rating of 1.12 is good for GM, but until a more positive price trend forms, the stock is rated a HOLD in the VectorVest system.

Whether you’re currently invested in GM or looking for an opportunity to trade this stock, there are a few other things you should see, too. Take a moment to review this free stock analysis and set yourself up for a smooth, profitable trade today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. GM is down today after a previous bull moved his stance from buy to hold, lowering his price target slightly. Still, VectorVest shows that the stock has excellent upside potential with fair safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment