Shares of Gap Inc. (GAP) surged nearly 16% after-hours on Thursday following the retailer’s impressive third-quarter earnings and positive forecast for the holiday season. Despite challenges like unseasonably warm weather and hurricanes, the company exceeded expectations with strong results, driving confidence in its growth potential.

Gap raised its full-year sales outlook, now expecting a 1.5%-2% increase, compared to prior guidance of “slightly up.” The retailer’s third-quarter earnings came in at $274 million, or 72 cents per share, exceeding analyst expectations of 58 cents. Net sales also grew 2% year-over-year to $3.83 billion.

CEO Richard Dickson highlighted a “strong start” to the holiday season, fueled by the continued turnaround at Gap, Old Navy, and Athleta brands. With marketing strategies and a revamped product offering, the company is poised for growth heading into the key fourth quarter.

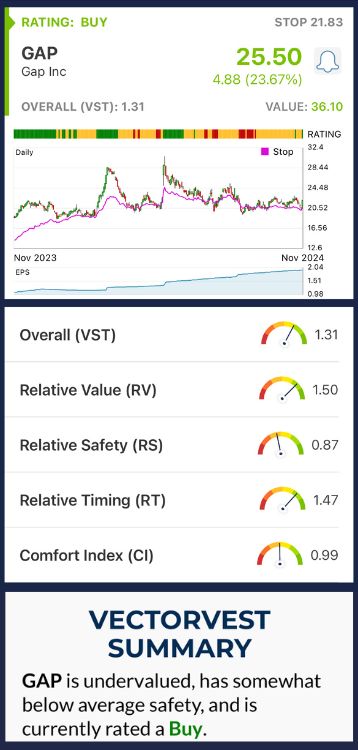

GAP Has Excellent Upside Potential, Fair Safety, and Fair Timing

The VectorVest system simplifies your trading strategy, replacing complex technical indicators and time-consuming analysis with 3 proprietary ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average. Based on the overall VST rating for a given stock you’re given a clear buy, sell, or hold recommendation - eliminating all guesswork and emotion from your decision-making. As for GAP, here’s what we found:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a much better indicator than the typical comparison of price to value alone. GAP has an excellent RV rating of 1.50, indicating strong long-term growth potential.

- Fair Safety: The RS rating is a risk indicator derived from an analysis of a company’s financial consistency, debt-to-equity ratio, business longevity, and other factors. GAP has a fair RS rating of 0.87, signaling average risk relative to other stocks.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. GAP has an excellent RT rating of 1.47, reflecting its strong performance so far this year.showing stable but improving price trends.

The overall VST rating of 1.31 is very good, indicating that Gap is currently a BUY according to the VectorVest system. Before making any moves, take a moment to assess this free stock analysis and get the full picture on Gap's potential!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Gap (GAP) surged 31% Friday morning after reporting third-quarter earnings that surpassed both top and bottom-line estimates, while also raising guidance for the year. Despite the challenges of an uncertain holiday season, the company showed optimism and progress in its turnaround efforts. While GAP has good upside potential and fair safety, its fair timing rating reflects its recent volatility. The stock has gained more than 74% over the past few months, demonstrating excellent short-term performance despite its longer-term challenges.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment