FuboTV (FUBO) reported company earnings this morning, and so far in Friday’s trading session, the market has rewarded the streaming provider with a nearly 9% bump for its efforts. The results came in well above analyst expectations.

Despite taking a net loss for the second quarter of $49.9 million, or 17 cents/share, FuboTV took a big step forward over the past year. This time in 2022 the loss was $116.1 million, or 63 cents/share. And, analysts were expecting much worse with a projected loss of 30 cents/share.

Revenue shot up by nearly 40% year over year to $312.7 from $222.1 million last year. This was well above the analyst outlook of $302.3 million. Much of this can be attributed to subscriber growth. The streamer reported 1.167 million North America subscribers for the quarter, compared to the 1.125 million analysts were looking for.

Looking ahead to the current quarter, FuboTV expects to see subscribers climb to somewhere between 1.327 million to 1.347 million. This is right in line with what analysts are projecting.

The company has also raised its full-year guidance. The new revenue target is $1.26 billion to $1.28 billion for the full year compared to the previous outlook of $1.235 billion to $1.265 billion in revenue.

In a letter to shareholders, FuboTV says that it’s full steam ahead as the company has ample liquidity to allocate towards its operating plan. With the wind in its sails, the goal of being cash flow positive by 2025 is well within reach.

That being said, is it time to buy FUBO now and jump aboard the trend that’s been forming for this stock? It’s rallied more than 57% in the past month and 156% in the last 3 months. Is there any room for this trend to continue?

We’ve taken a look at FUBO through the VectorVest stock analysis software and have 3 things we want to share with you to help you make your next move with complete confidence and clarity.

Despite Poor Upside Potential and Safety, FUBO Has Excellent Timing

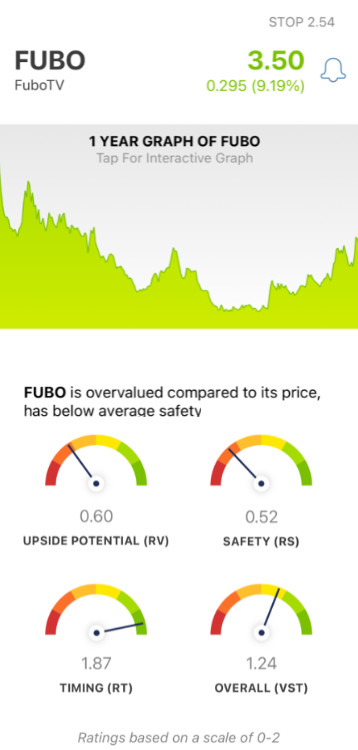

The VectorVest system simplifies your trading strategy by giving you all the insights you need to make emotionless, calculated trades in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on a scale of 0.00-2.00, with 1.00 being the average. But based on these ratings, the system is able to offer you a clear buy, sell, or hold recommendation - for any given stock, at any given time. As for FUBO, here’s what we’ve uncovered:

- Poor Upside Potential: The RV rating is a comparison between a stock’s long-term price appreciation potential and AAA corporate bond rates and risk. It offers far better insights than a simple comparison of price to value alone. And right now, FUBO has a poor RV rating of 0.60. It’s also overvalued, with a current value of just $1.43.

- Poor Safety: RS is an indicator of risk and assesses a company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. As for FUBO, the RS rating of 0.52 is poor.

- Excellent Timing: Here’s where things get interesting - the RT rating of 1.87 is excellent. This is based on the direction, dynamics, and magnitude of the stock’s price trend day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.24 is good for FUBO, but is it simply skewed by the RT rating? Does excellent timing outweigh poor safety and upside potential, or is it the other way around?

You don’t have to play the guessing game or let emotion influence your decision-making. A clear buy, sell, or hold recommendation is just a click away - get a stock analysis free today to find out what you should do with FUBO.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Despite the excitement over earnings and excellent timing, FUBO still has poor upside potential and safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment