Ford had climbed nearly 5% in the past week before yesterday’s announcement, in which the company admitted that profitability from the EV business is years down the road. This sent shares back down where they came from – and has investors wondering if it’s worth holding on much longer.

In Thursday’s statement, CFO John Lawler spoke about these losses – which are in the billions of dollars. He says it will be at least three more years before Ford is able to see a profit on these vehicles they’ve been developing.

He attempted to rationalize the $3 billion loss on Ford’s balance sheet by comparing this segment to a “new EV startup within Ford.” He went on to say that, as everyone knows, losses like these are to be expected as the “startup” gains capability, develops knowledge, builds volume, and gains share.

With that said, Ford isn’t a startup – the automotive manufacturer has been around for nearly 120 years. Investors are having a hard time coming to grips with waiting for that much longer. But, this is part of the overarching restructuring changes occurring within the company – as the other two segments (gas-powered and commercial fleets) are driving solid profitability to make up for the loss ($7 billion and $6 billion respectively).

And by 2026, Ford expects profit margins of around 8% for the EV business – while also ramping production from 2023’s target of 600,000 to a whopping 2 million+.

But, is it worth waiting that long to see these results come to fruition? Or is it time to get out of Ford and move your capital to another opportunity? Below, we’ll help you find a clear answer on what you should do with this stock by taking a look at it through the VectorVest stock analyzing software.

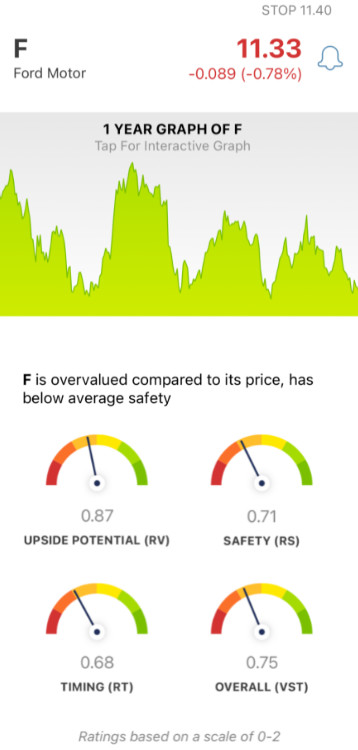

Ford Still Has Fair Upside Potential, But Poor Safety and Timing

The VectorVest system helps you simplify your trading strategy to win more trades with less work. It tells you what to buy, when to buy it, and when to sell it. It’s all possible through three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on its own scale of 0.00-2.00, with 1.00 being the average - allowing for quick and easy interpretation. But, to make things even easier, VectorVest provides a clear buy, sell, or hold recommendation based on these ratings: for any given stock, at any given time. As for F, here’s what you need to know:

- Fair Upside Potential: The RV Rating of 0.87 is a ways below the average, but is still considered fair nonetheless. This rating is a comparison between the stock’s 3-year price appreciation potential and AAA corporate bond rates while taking risk into account as well.

- Poor Safety: Speaking of risk, F has poor safety right now - with an RS rating of just 0.71. This is calculated by analyzing the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Poor Timing: To make matters worse for F investors, the timing is poor right now - as indicated by the RT rating of 0.68. This is an indicator of the stock’s price trend, and is based on the direction, dynamics, and magnitude of price movement day over day, week over week, quarter over quarter, and year over year.

All things considered, the overall VST rating for F is poor at 0.75. Does that mean it’s officially time to cut losses on this stock and sell? Or, should you hold on a bit longer? Don’t play the guessing game or let your emotions influence your decision-making. Get a clear answer on your next move through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for F, it is overvalued right now with fair upside potential - but the safety and timing are poor, and investors who are excited about the EV segment have a ways to go before seeing profits.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment