Foot Locker Inc. (FL) is facing a tough road ahead, as reflected in its third-quarter earnings report and revised outlook for the rest of the year. The company reported a net loss of $33 million, or 34 cents per share, a stark contrast to last year’s profit of $28 million. Sales declined 1.4% to $1.96 billion, with comparable sales growth of just 2.4%, falling short of analysts’ expectations of 3.2%.

CEO Mary Dillon pointed to a softer back-to-school season and an overly promotional environment as key factors contributing to the underperformance. As a result, Foot Locker lowered its full-year sales forecast, now expecting a decline of 1% to 1.5%, compared to earlier projections for modest growth. The company also reduced its EPS guidance, now forecasting between $1.20 and $1.30, down from the previous range of $1.50 to $1.70.

While Foot Locker saw a slight bump in sales during Thanksgiving week, it remains challenged by cautious consumer behavior and fierce competition. Despite continuing with its “Lace Up” plan, which includes store closures and new concept shop openings, the company’s path to recovery remains unclear.

Despite Weak Safety and Timing, FL Has Fair Upside Potential

The VectorVest system simplifies your stock analysis by providing three clear ratings that help you make informed decisions—eliminating guesswork and emotion. These ratings are relative value (RV), relative safety (RS), and relative timing (RT).

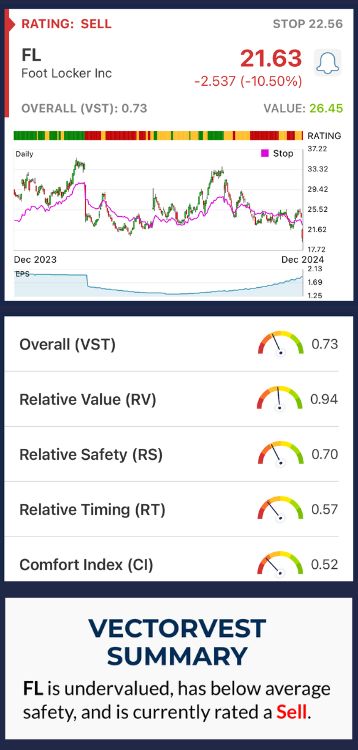

Each rating sits on a scale of 0.00-2.00, with 1.00 being the average. Based on the overall VST rating, the system offers a buy, sell, or hold recommendation at any given time. Here’s what we found for FL:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. FL has an RV rating of 0.94, which suggests fair upside potential. The stock is slightly undervalued but doesn’t show strong long-term growth prospects at this point.

- Poor Safety: The RS rating assesses the company’s financial consistency, predictability, debt-to-equity ratio, business longevity, and other factors. With an RS rating of 0.70, FL has poor safety, indicating higher risk. The company is facing challenges with consumer demand and increased costs, which heighten the risk for investors.

- Very Poor Timing: The RT rating, which measures the stock’s price momentum, reflects very poor timing for FL, with an RT rating of 0.56. Despite some positive trends in November, the stock’s overall performance has been weak, making its short-term outlook uncertain.

With an overall VST rating of 0.73, FL receives a SELL recommendation. Despite some upside potential, the company’s weak safety and poor timing suggest caution for investors at this time. Get a free stock analysis to learn more and see what the future holds for FL.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. FL faces several challenges for the remainder of the year. For now the stock carries a SELL recommendation, and investors should consider the risks carefully.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment