For years, efforts here on the homefront have been to increase US manufacturing – preventing money from going overseas. The latest in cutting back on imports comes from President Biden’s push to accelerate domestic manufacturing through legislation. The inflation reduction act (IRA) became law on August 16, 2022 and sets aside about $30 billion in tax credits for businesses for solar panels, wind turbines, batteries, and more. But, the most relevant aspect of the law is the $10 billion tax credit set aside for creating clean technology manufacturing facilities – such as the type necessary for producing solar panels. This is where First Solar Inc. (FSLR) comes in.

The largest solar manufacturer has released its plans to invest over $1 billion in US-based manufacturing plants. A brand new fully vertically integrated factory is coming to the southwest – and, the company is allotting $185 million to upgrade and expand its Ohio facility. First Solar Inc. admits this decision came entirely from the passing of the IRA – and this key piece of legislation is one the company has been awaiting eagerly for years. Analysts and executives alike recognize how significant this will be for the solar industry as a whole.

And, as the expansion news has rippled through the country, so too has FSLR stock risen. In fact, the stock is up 15% overnight pending the expansion news. This uptick comes on the heels of what has already been an outstanding month for First Solar Inc., as they’re up 25% over the past 30 days and up 71% over the past 3 months.

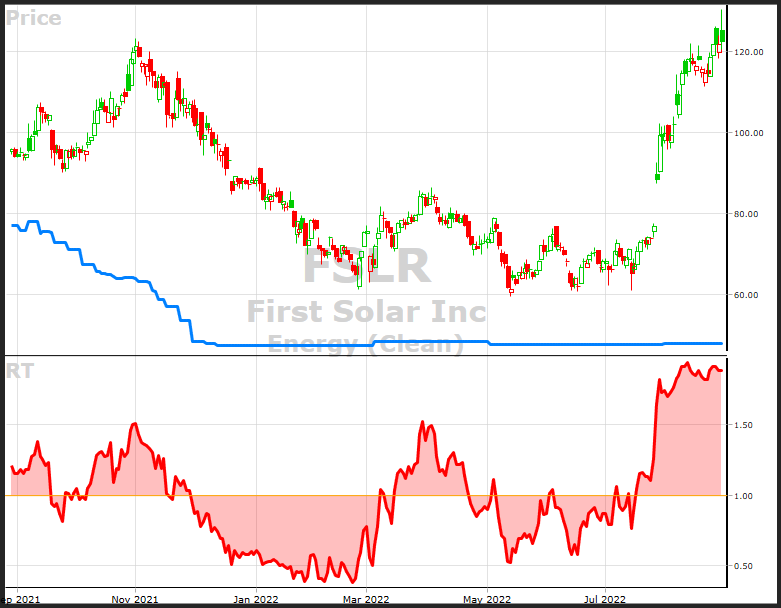

But – when evaluating First Solar Inc. using a tried and true stock analysis system, what can we see? VectorVest’s stock forecasting system makes it easy to tune out the noise and just analyze a company’s stock based on three emotionless factors: Relative Value (RV), Relative Safety (RS), and Relative Timing (RT). These three indicators summarize all other forms of technical and fundamental analysis and just show you what you need to know. Together, they make up the VST rating a stock is given – and from there, dictate whether the VectorVest system rates the stock a buy, sell, or hold. And right now, First Solar Inc. has incredible momentum pushing the price up. But, that’s where the good news ends.

Excellent Momentum is the Only Reason to Consider Buying FSLR Right Now

There’s no doubt about it – the news of FSLR’s expansion plans has further strengthened what was already a very strong trend pushing the stock’s price up. In fact, it has a RT rating of 1.90 – which is excellent on a scale of 0.00-2.00. This rating confirms that the direction, magnitude, and dynamics of the stock’s price movement are favorable for investors right now. However, the timing is really the only reason to consider buying FSLR, making it a speculative trade..

The upside potential for FSLR is very poor – with an RV rating of 0.46. This suggests the long term price appreciation potential is weak. Furthermore, the stock is way overvalued at its current price of $124 – VectorVest has calculated its value at just $48, with a negative forecasted earnings growth rate of -.6%. This is coupled with a below-average RS rating of 0.95. These two ratings suggest the stock is volatile and cannot withstand severe or lengthy price declines.

Altogether, the overall VST rating for First Solar Inc. sits at 1.32. This is very good – but should the trend start to weaken, investors will need to get out quickly. Our system recommends setting a stop loss of $97.36 as the ultimate line in the sand, if the stock starts selling off. Is FSLR rated Buy, Sell or Hold? – Click here for the full report.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for First Solar Inc., it is significantly overvalued, has very poor upside potential and below-average safety – but shows a very strong price trend. Investors who buy or own it now should do so cautiously and maintain a close eye on this price trend – in the event of a reversal, you’ll want to close your position quickly. As the RT rating starts to drift back towards 1.00 and away from 2.00, it will suggest the trend is losing momentum. Get the VectorVest mobile app for unlimited updates.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment