It was a bad day for tech companies in the European Union (EU) court system as both Apple (AAPL) and Google (GOOGL) lost their battles and will face hefty financial penalties as a result.

Apple was fighting a €13 billion ($14.4 billion) Irish tax bill, which can be traced all the way back to 2016. CEO Tim Cook says it’s “total political crap,” while a spokesperson for the company went on to express the company’s frustration over the verdict.

“We are disappointed with today’s decision as previously the general court reviewed the facts and categorically annulled this case.”

However, the ruling is final and the company anticipates recording a one-time income tax charge of roughly $10 billion for fiscal Q4 this year, which will end September 28. This will in turn raise Apple’s tax rate for the period.

Many believe the EU’s antitrust chief Margrethe Vestager had it out for tech companies since being appointed back in 2014. She set her sights on Apple and Google specifically, but Amazon has been a company of interest as well.

Vestager says that this decision is important for showing European taxpayers that corporate giants are not exempt from tax law, and went on to make it clear that selective tax benefits to big firms are illegal state aid and will not fly in the EU.

AAPL hasn’t moved much yet this morning on the news, but has been steadily trending downward over the past week. The stock has fallen roughly 5%. But, it’s still up nearly 17% through 2024 thus far.

If you’re currently invested in AAPL or want to see if there’s an opportunity here to trade this stock, you’re in luck. We’ve taken a closer look through the VectorVest stock software and found 3 things you need to know.

AAPL Still Has Fair Upside Potential and Timing With Very Good Safety

VectorVest is a proprietary stock rating system that distills complex technical and fundamental data into clear, actionable insights, saving you time and stress as you win more trades.

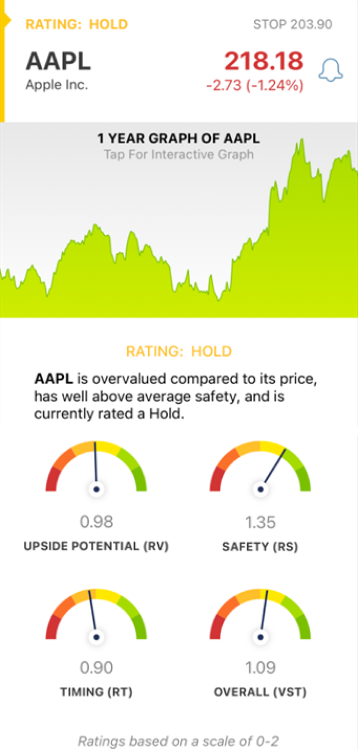

You’re given everything you need to know to make calculated, emotionless investment decisions in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

It gets even better, though. You’re given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what you need to know about AAPL.

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. AAPL has a fair RV rating of 0.98.

- Very Good Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.35 is very good for AAPL.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 0.90 is fair for AAPL.

The overall VST rating of 1.09 is also fair for AAPL, and results in a HOLD recommendation for the stock at this time.

However, there are a few more things you should be aware of whether you’re a current investor or waiting for an opportunity to trade this stock. So, get a free stock analysis at VectorVest today to fully capitalize!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. AAPL will be hit with a $14.4 billion back tax bill after the EU’s latest ruling, which will be recorded for the fiscal fourth quarter. The stock itself has very good safety while upside potential and timing are just fair.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment