The Swedish telecommunications company Ericsson (ERIC) is up more than 13% so far Tuesday morning after posting third-quarter earnings that easily surpassed expectations.

The company brought in 7.327 billion Swedish crowns, which works out to roughly $0.7 billion. This was well ahead of the 5.75 billion crown analysts were anticipating for earnings. It was also a massive improvement year over year from the 3.9 billion Swedish crowns in Q3 2023.

What makes this earnings performance even more impressive is that Ericsson accomplished it with lower net sales, which fell 4% in the quarter to just 61.8 billion Swedish crowns. Still, this was slightly ahead of the consensus call for 61.6 billion Swedish crowns.

The real highlight for the Sweden-based telecom business was its ability to gain a solid footing here in the North American market. Sales were up more than 50% year over year.

This builds on last year’s performance in which the company beat its Finnish competitor Nokia to earn a contract for building out an ORAN technology telecommunications network. This network is expected to cover as much as 70% of AT&T traffic within the next 2 years.

CEO Börje Ekholm says that he is pleased with the company’s quarter, and more importantly, its prospects for the road ahead. The North American market has been a challenging target for some time, but Ekholm believes it is stabilizing and he remains optimistic about its potential.

However, there were struggles in other segments, like India. After a torrent pace for 5G rollouts in 2023, expectations for the Asian market were lofty – or according to Ekholm, “distorted.” Still, he reiterates that growth opportunities exist in the region.

All in all it was a solid third quarter for Ericsson, which saw gross margin improvement from just 39.2% this time last year to now 46.3%. This performance prompted analysts to revise their consensus for the full year, now expecting a 5-10% improvement.

This couldn’t have come at a better time for the Swedish company which came under fire after sharing its plans to eliminate up to 1,200 jobs amidst slowing demand for its products. The stock fell as much as 15% on that news.

However, ERIC has certainly turned things around, up nearly 37% through 2024 thus far and continuing its trend today. So, is this the right time to buy ERIC? We’ve taken a look through the VectorVest stock analysis software and uncovered 3 things you need to know before deciding.

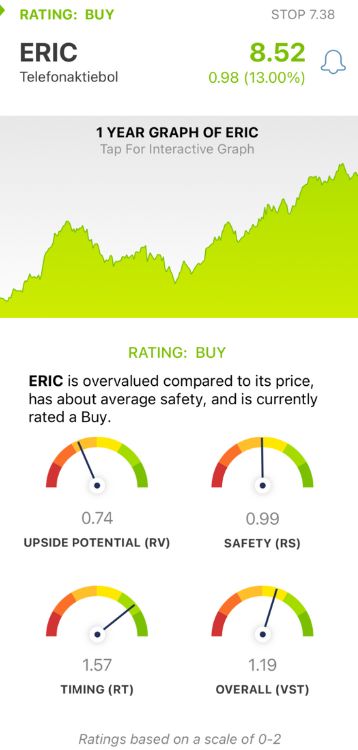

ERIC Has Poor Upside Potential, But Fair Safety and Excellent Timing Make it a BUY

VectorVest simplifies your trading strategy by delivering all the clear, actionable insights you need to make calculated, emotionless investment decisions in just 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. It gets even better, though - you get a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for ERIC:

- Poor Upside Potential: The RV rating is a far superior indicator than the typical comparison of price to value alone, as it compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. As for ERIC, the RV rating of 0.74 is poor.

- Fair Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.99 is just below the average for ERIC, but fair nonetheless.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.57 is excellent and reflects the surge ERIC has been on since April.

The overall VST rating of 1.19 is good for ERIC and enough to earn the stock a BUY recommendation in the VectorVest system. But before you make that next move, take a closer look at the opportunity with a free stock analysis to set yourself up for a smooth, profitable trade!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. ERIC is up 13%, making it a nearly 37% gain on the year. This comes on the heels of a solid Q3 performance that featured improvements in the North American market. The stock itself may have poor upside potential, but fair safety and excellent timing make it a buy.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment