Shares of Domino’s Pizza (DPZ) are up nearly 3% in Thursday morning’s trading session after the company reported massive profit growth that exceeded analyst expectations for the third quarter.

Earnings per share came in at $4.18 compared to just $3.31 that analysts were looking for. However, revenue of $1.03 billion was a step backward year over year, representing a 3.9% decrease. It also fell short of the $1.05 billion analyst estimate.

The pizza chain noticed a slight fall off in total domestic stores’ comparable performance, with sales growth down 0.6% compared to the 0.1% growth analysts were projecting. Meanwhile, domestic franchise comparable sales were down 0.7%, another miss. The consensus was for growth of 0.2%.

One of the more promising takeaways from the quarter was growth overseas. International comparable sales grew 3.3% compared to the 2.8% analysts were hoping for.

CEO Russel Weiner attributed much of this success to the company’s “summer of service” initiative. This, paired with the hard work of team members, brought pizza delivery timelines back down to where they were before the pandemic.

Moreover, the company’s rewards program is paying dividends in keeping customers engaged. And with an integration through Uber’s marketplace, the company is poised to deliver impressive growth through 2024 and beyond.

That being said, Domino’s Pizza is expecting global net store growth for the year to match up to its 5%-7% 2-3 year outlook. Global retail sales growth for the year will likely fall just below the mid-range of its 4%-8% 2-3 year outlook.

DPZ has climbed nearly 18% in the last year, but the short-term trend has been poor. The stock is down more than 8% over the last few months. Investors are hopeful that today’s turnaround spurs a more positive price trend and sends shares back in the right direction.

We’ve taken a look at DPZ through the VectorVest stock analysis software to dig deeper. In the process, we uncovered 3 things that you’re going to want to see if you’re interested in this stock.

DPZ Has Fair Upside Potential and Timing With Good Safety

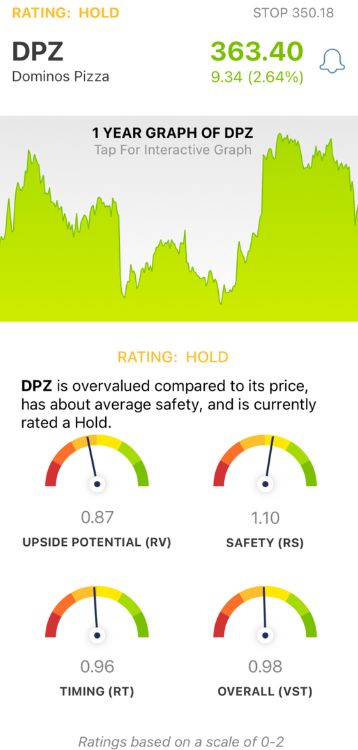

VectorVest simplifies your trading strategy, empowering you to win more trades with less work and stress. You’re given all the insights you need to make calculated, emotionless decisions in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on an easy-to-understand scale of 0.00-2.00, with 1.00 being the average. You’re given a clear buy, sell, or hold recommendation based on the overall VST rating for a given stock. As for DPZ, here’s what we found:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. As for DPZ, the RV rating of 0.87 is fair - albeit a ways below the average. However, the stock is overvalued with a current value of just $248.81.

- Good Safety: The RS rating is an indicator of risk, derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. DPZ has a good RS rating of 1.10.

- Fair Timing: The RT rating speaks to a stock’s price trend. It’s based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. As for DPZ, the RT rating of 0.96 is a bit below the average - but deemed fair nonetheless.

The overall VST rating of 0.98 is just below the average and considered fair. So, where does that leave investors or prospective traders - should you buy or sell this stock right now?

Neither, actually. VectorVest rates DPZ a hold right now based on the current information available. Learn more through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. DPZ has climbed almost 3% after delivering a slightly mixed bag in the third quarter’s earnings report. The stock has fair upside potential and timing with good safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment