Shares of Walt Disney (DIS) are down more than 57% from the high we saw in 2021, and stock is down 18% in the past 3 months alone. While some look at this dip as a buying opportunity, we see reasons to steer clear of DIS for the time being.

The company has been the center of turmoil and uncertainty since the return of Bob Iger, which led to an attempted overtake by an activist investor group. The proxy vote eventually led to extending Iger’s contract through 2026, creating some semblance of certainty for the road ahead.

Disney has been performing well over the past few quarters, too. Its second-quarter earnings were comfortably ahead of the analyst consensus back at the beginning of May. At the time, the stock sat at $104 per share and had just fallen 10%. Today, DIS is only $86/share.

More recently, the company’s third-quarter earnings results showed positivity. Revenue was up 4% year over year to $23.2 billion as the experiences and entertainment divisions both showed growth.

Profit pushed higher, too, as the company saw adjusted earnings per share spike 35%. One of the key focuses for management has been to bring costs down, resulting in the reduction of $7.5 billion across different areas of the business.

The past two-quarters of performance has led to an increase in the full-year outlook as management is optimistic about how the company can finish the year. EPS growth is currently slated for 30% higher than in 2023.

The biggest issue for Disney right now is how it will transition away from cable and towards streaming. Netflix dominates the space, but give credit where it’s due – Hulu, Disney+, and ESPN+ all live under the Disney umbrella and just reported a profit after a massive $512 million loss this time last year.

All that being said, where does this leave you? Is now a good time to buy DIS heading into the final quarter of the year? We’ve taken a look at this opportunity in the VectorVest stock forecasting software and see 3 things you need to consider before you do anything else.

DIS Has Fair Upside Potential and Safety With Poor Timing

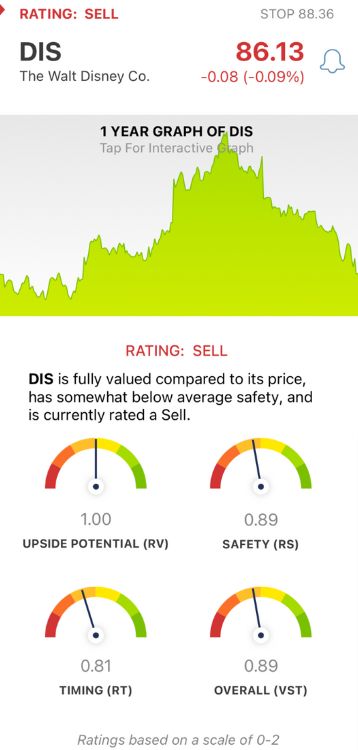

VectorVest is a proprietary stock rating system that delivers clear, actionable insights in just 3 simple ratings, saving you time and stress while helping you win more trades. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average. This allows for quick and easy interpretation. But, it gets even better. The system issues a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for DIS:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. DIS has a fair RV rating right at the average of 1.00.

- Fair Safety: The RS rating is a risk indicator. It’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. DIS has a fair RS rating of 0.89, albeit a ways below the average.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. This is the biggest issue for DIS right now - the stock continues to fall lower and lower. It has a poor RT rating of 0.81.

The overall VST rating 0.89 is fair for DIS, but the stock is still rated a SELL in the VectorVest system. Take a moment to learn more about why you need to cut losses on this stock if you haven’t already - get a free stock analysis at VectorVest and transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. DIS is down 57% from its 2021 peak, and it continues to fall lower and lower more than halfway through 2024 despite positive earnings results and an upbeat outlook. The stock may have poor timing, but its upside potential and safety are still fair.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment