Shares of Dish Network Corporation (DISH) dropped more than 22% Monday morning. The company delivered third-quarter earnings that shocked the market, posting an unexpected loss amidst dwindling subscribers.

The pay-TV and wireless company reported a dramatic 9.5% drop in revenue, falling short of the expectation. Revenue of $3.70 billion was well below the FactSet consensus of $3.82 billion.

Profits suffered as well, as Dish posted a net loss of $139 million, or 26 cents a share. This was a stark comparison to the company’s performance last year, in which Dish reported net income of $412 million, or 65 cents a share. Meanwhile, analysts were forecasting 11 cents per share.

The company attributes this poor performance to subscribership falling in both net Pay-TV subscribers and retail wireless subscribers. Both of these segments grew last year but fell 64,000 and 225,000 respectively this year.

The one positive take away from the third quarter was an increase in average revenue per Pay-TV user, up 3.1% to $105.25.

Dish finds itself in a tumultuous state right now as its CEO Erik Carlson also announced his intention to step down after serving the company in some form or another for nearly three decades.

This was something we were expecting, though, as it had been discussed in the past during the merger with EchoStar. EchoStar Chief Executive Hamid Akhavan will step into the role of CEO effective November 13th, while Carlson remains on the board until the merger is completely finished.

The stock was rallying in the right direction leading into this weekend, showing investor excitement over what was expected to be a positive performance. The stock has now lost 43% of its value in the past 3 months.

We’ve taken a deeper look at DISH through the VectorVest stock analysis software. There are three things you need to see if you’re currently invested in this stock or are considering trading it…

Despite Fair Upside Potential, DISH Has Poor Safety and Very Poor Timing

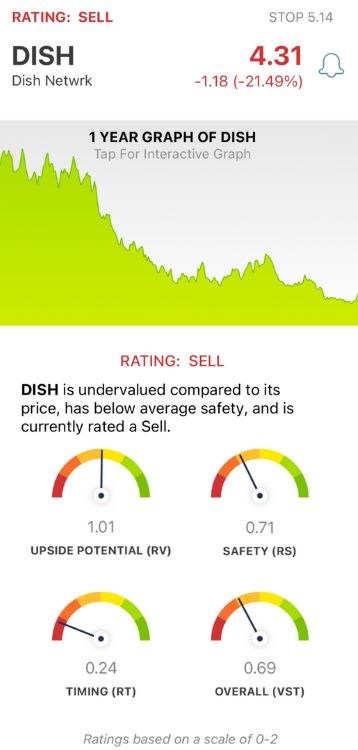

VectorVest saves you time and stress while empowering you to win more trades. The proprietary stock rating system gives you all the insights you need in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average. This makes interpretation quick and easy. You’re also given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for DISH, here’s what we found:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. It’s a far superior indicator than a simple comparison of price to value alone. The RV rating of 1.01 is just above the average and considered fair for DISH. The stock is also undervalued right now, with a current value of $6.37.

- Poor Safety: The RS rating is an indicator of risk. It’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other risk factors. DISH has a poor RS rating of 0.71.

- Fair Timing: As you can see looking at the stock’s performance over the past few months, DISH has very poor timing, and the RT rating of 0.24 reflects that. The rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.69 is poor, and VectorVest recommends SELLING DISH right now. Learn more about how the system works through a free stock analysis today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. DISH fell more than 22% Monday morning after an unexpected underperformance in the third quarter. The stock has fair upside potential with poor safety and very poor timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment