Cisco Systems Inc. (CSCO) gave an update for the fiscal third quarter along with the current quarter yesterday after the market closed. Shares had rallied as much as 9%, but the stock has actually begun to dip back in the red Thursday morning, down nearly 2% so far today.

Much of this is the result of a disappointing performance in Q3, in which the top and bottom lines both took a hit. Revenue slipped to $12.70 billion from $14.57 billion but was just ahead of the analyst consensus of $12.53 billion.

Meanwhile, net income fell from $3.21 billion this time last year to just $1.89 billion – or 78 cents per share compared to 46 cents per share. However, the company managed to come out with an earnings beat on an adjusted basis, with 88 cents per share compared to the 83 cents FactSet was calling for.

Chief executive with the company Chuck Robbins says that demand has sunk as many customers are still digesting past purchases. But, the expectation is that many of these customers will finish installations of current inventory before the fiscal year ends in just a few months.

In this sense, Robbins sees demand picking up for the second half of the calendar year. Adding Splunk to the product lineup will help push growth even further. The company is also working diligently to use AI as part of its core offerings, with the expectation that this technology could add $1 billion in sales by fiscal 2025.

As a result of all this, Cisco issued an outlook for the current quarter of $13.4-$13.6 billion in revenue alongside adjusted earnings of 84-86 cents per share. This is right in line with the FactSet consensus of $13.25 billion in revenue and 86 cents per share on an adjusted basis.

There was optimism yesterday that this outlook could turn things around and start a positive trend for CSCO, but that hope came to an abrupt halt today. The stock is down nearly 4% through 2024. Where does that leave investors?

We’ve found 3 other things that any current or prospective CSCO investor needs to see through the VectorVest stock analysis software.

CSCO Has Very Good Upside Potential With Fair Safety and Timing

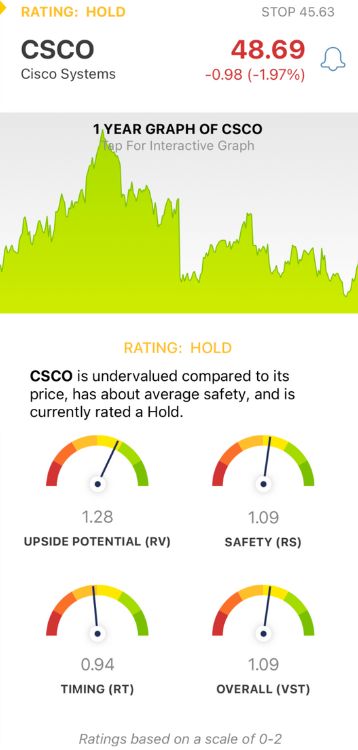

VectorVest analyzes 16,000 stocks daily and uses a proprietary algorithm to deliver clear, actionable insights in just 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Interpretation is quick and easy as each sits on a simple scale of 0.00-2.00, with 1.00 being the average. Better yet, the system gives you a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what you need to know for CSCO:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This balanced view offers far superior insights than the typical comparison of price to value alone. CSCO has a very good RV rating of 1.28.

- Fair Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. CSCO is a fairly safe stock with an RS rating of 1.09.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year to paint the full picture for investors. CSCO has a fair RT rating of 0.94, just below the average.

The overall VST rating of 1.09 is fair for CSCO, but not quite enough to earn the stock a buy recommendation. It’s currently rated a HOLD in the VectorVest system.

You can take a moment to learn more about this opportunity with a free stock analysis today. Transform the way you find and analyze opportunities to win more trades with less work and stress through VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. CSCO delivered a lackluster Q3 performance in which profits and revenue both took a hit, but the company does see clear skies ahead as demand should get a boost. In the meantime, the stock has very good upside potential with fair safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment