It’s like clockwork. Anytime there’s tension in the Middle East it poses a threat to the world’s oil supply, and prices surge accordingly. That’s what we’re seeing this morning for energy stocks like Chevron (CVX) and ExxonMobil (XOM).

These stocks are up nearly 6% and 7% respectively in the past week, and they’re up marginally today as well. This is the result of crude oil prices climbing roughly 3% after Iran launched its attack on Israel earlier this week.

The US benchmark for crude oil prices is the West Texas Intermediate (WTI), and it’s currently sitting at $72 per barrel. Brent crude futures briefly crossed the $75-per-barrel level Tuesday amidst the turmoil, too.

Mark Haefele with UBS Global Wealth Management spoke to what we’re seeing, noting that the potential interruptions to oil supply that would arise from a regional war in the Middle East are enough to create market volatility.

Haefele isn’t expecting an all-out war in his analysis for these stocks, but still, holding energy stocks like CVX or XOM can hedge against the toll a worsening crisis in the Middle East could take on a portfolio.

Zeroing in on Chevron specifically, it’s been quite the week. The company’s acquisition of Hess Corporation has been a tumultuous topic over the past few months, and the deal finally cleared this week. Chevron has been targeting Hess’s assets in Guyana.

So, is this a good time to buy CVX as everything looks to be lining up for the company? Not quite. We’ve taken a closer look in the VectorVest stock forecasting software and found 3 things you need to be aware of before you make your next move one way or the other.

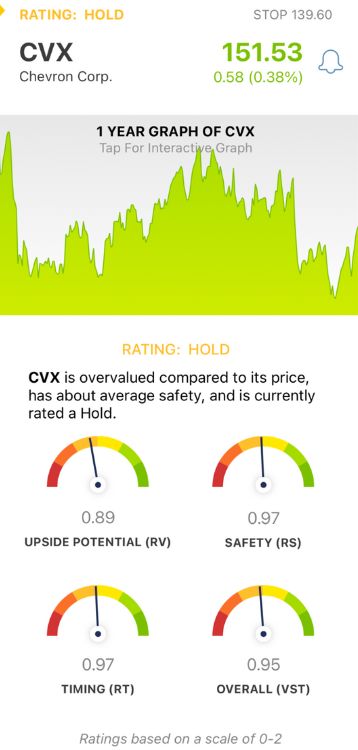

The Fair Upside Potential, Safety, and Timing for CVX Result in a HOLD Recommendation

VectorVest is a proprietary stock rating system that’s designed to save you time and stress while empowering you to win more trades. You’re given all the insights you need in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. Better yet, you’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s the situation for CVX:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. CVX has a fair RV rating of 0.89. The stock is slightly overvalued, with a current value of just $128.63.

- Fair Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. CVX has a fair RS rating of 0.97.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 0.97 is fair for CVX.

The overall VST rating of 0.95 is also fair for CVX and it results in a HOLD rating in the VectorVest system for the time being.

If you want to dig a bit deeper into this opportunity so you can fully capitalize when the timing is right, get a free stock analysis at VectorVest today. You can also get an analysis for XOM if you want to see how it stacks up to CVX.

Transform your trading strategy for the better with VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. CVX and other energy stocks are climbing higher amidst turmoil in the Middle East. But, it’s not quite time to buy this particular stock yet - its upside potential, safety, and timing are all just fair.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment