Thursday, President Joe Biden announced that he will be pardoning thousands of people convicted of marijuana possession under federal law. It’s worth noting that those who are being pardoned were convicted of l simple misdemeanor charges.

While it may not appear that this is more than a quick win for cannabis users around the country, cannabis companies like Canopy Growth – along with their investors – are incredibly excited about this news. In fact, the news of these pardons sent CGC stock up a whopping 34% in just a few hours.

This perhaps was the result of Joe Biden doubling down on this move – stating publicly that lawmakers need to evaluate how cannabis is looked at in the eye of the law. He went on the record saying “it makes no sense” and that he would be tapping federal departments of justice along with health and human services to review the current legislature.

Why did this news send Canopy Growth soaring? Because it’s one step closer to what these companies have long been awaiting: federal decriminalization. It’s not a matter of “if” cannabis becomes 50-state legal – it’s a matter of when. And, it seems we are inching closer and closer as time goes on.

Canopy Growth executives praised Biden’s move with a press release of their own. David Culver also echoed President Biden’s sentiment that the change in cannabis legislation is long overdue.

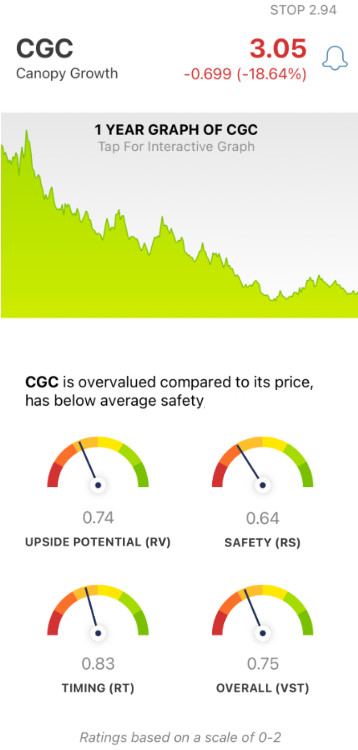

However, the excitement was short-lived for CGC stock. While it soared 34% in less than a day, it returned almost to where it started the day by the market open today. The stock has dropped 19% so far today and appears to be moving lower and lower. So – from an investment standpoint, is it too late for you to get into the stock? Has the short-term window closed? Or, should you get in now ahead of the next positive news to come out?

We don’t know what’s going to happen in the short term for cannabis legislation. What we do know is that VectorVest can provide you with everything you need to know to make your next move with this stock. Keep reading to discover a clear buy, sell, or hold recommendation for Canopy Growth stock based on tried-and-true stock analysis software.

Despite a Positive News Cycle, VectorVest Sees 3 Red Flags in CGC Stock

VectorVest simplifies stock analysis for investors by providing you with three simple ratings to inform your decision-making: relative value (RV), relative safety (RS), and relative timing (RT). These three ratings tell you everything you need to know about a stock – and they’re easy to understand, as they sit on a simple scale of 0.00-2.00. The higher the rating, the better.

And based on these three ratings, VectorVest provides an overall VST rating – which deems whether the stock is rated a “buy”, “sell”, or “hold”. This allows you to invest in confidence with no emotion or guessing games. As for Canopy Growth, here’s what you need to know:

- Poor Upside Potential: There’s no question that eventually, cannabis stocks will have their day. However, VectorVest computes the long-term price appreciation potential for CGC to be poor with an RV rating of 0.74. This is calculated up to three years out. And to further validate this finding, VectorVest shows the stock to be overvalued at the current price of $3.07 – with a current value of just $2.64.

- Poor Safety: The RV rating takes a look at the risk for a stock. It analyzes the consistency and predictability of a company’s financial performance, coupled with business longevity, debt to equity, and other risk factors. As for CGC, the RV rating of 0.64 is poor.

- Poor Timing: Investors should buy stocks that are rising in value to achieve success in the stock market. And this time yesterday, the timing for CGC was excellent. However, that window has closed as the price trend has already reversed. Now, CGC stock is dropping lower and lower – and the poor RT rating of 0.83 reflects that. This rating looks at the direction, dynamics, and magnitude of a stock’s price trend. As this RT figure continues dropping lower and lower, it will signify a stronger trend.

All of these ratings considered, Canopy Growth has a poor VST rating of 0.75. But, does that necessarily mean you should sell any shares you have right now – or is it worth holding on through this uncertain period? Perhaps it’s more of a long-term buy? We can give you a clear answer on what your next move should be – just get a free stock analysis here!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to Analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As for CGC, it is overvalued with poor upside potential, safety, and timing – even despite the positive news that came out yesterday.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment