While all eyes are on stocks like NVDA, META, GOOG, and other companies staking their claims in the AI race, not enough emphasis has been placed on Broadcom (AVGO). The semiconductor and infrastructure manufacturer is well positioned to profit from this emerging technology.

In fact, the company delivered second-quarter results yesterday and reported $3.1 billion in revenue from AI products alone. The expectation is that AI sales will top $11 billion for the full fiscal year.

Revenue as a whole climbed to $12.5 billion for the quarter while earnings per share came in at $10.96. This results in a beat on both the top and bottom lines for the company.

One of the major takeaways from the earnings report, though, was the announcement of a 10-for-1 stock split. This is the first one the company has done since 2016 after its merger with Avago Technologies.

This essentially means any shareholders of record on Thursday, July 11 will get 9 more shares of common stock for each existing share they hold. So rather than holding one share worth $1,684 – where AVGO currently sits today – investors will own 10 shares valued at roughly $168.40 each.

So while the stake remains unchanged, the idea is that a stock split like this can spur investor excitement and encourage more trading. The idea of investing in the stock at today’s price can be overwhelming for some investors who will only hold a fraction of a share. But at a tenth of the price, AVGO will be easier to stomach for retail investors trading smaller position sizes.

So far, the announcement has done exactly what it was intended to do. AVGO has gained more than 13% today after the news, adding to its 55% rally through the first half of this year.

We’ve taken a closer look at this opportunity in the VectorVest stock software and found 3 other reasons to consider buying this stock, too. Here’s why you’re not going to want to miss out on AVGO…

AVGO Has Good Upside Potential With Excellent Safety and Timing

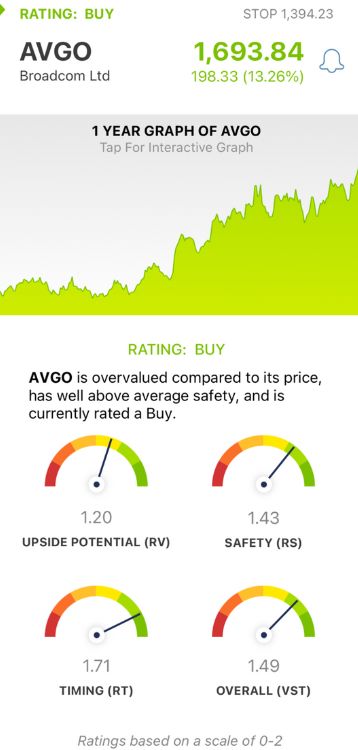

VectorVest is a proprietary stock rating system designed to save you time and stress while empowering you to win more trades. It does this by taking complex data and boiling them down into more digestible indicators.

In fact, you’re given all the insight you need in just 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each is placed on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

The system even gives you a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for AVGO:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This offers far superior insights than the typical comparison of price to value alone. AVGO has a good RV rating of 1.20 right now.

- Excellent Safety: The RS rating is a risk indicator. It’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.43 is excellent for AVGO.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year to give you the full view of a stock’s price trend. AVGO has an excellent RT rating of 1.71 reflecting its performance in both the short and long run.

The overall VST rating of 1.49 is excellent for AVGO and enough to earn this stock a BUY recommendation. That being said, you should take a quick look at this free stock analysis for deeper insights before you do anything else. Make your next move with complete confidence and clarity with the help of VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. AVGO is up more than 13% Thursday after an impressive second-quarter earnings performance was reported yesterday, along with a 10-for-1 stock split. The stock itself has good upside potential with excellent safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment