Late last week Bristol Myers Squibb (BMY) got a nice 8% boost after sharing news that it gained approval from the Food and Drug Administration (FDA) for its schizophrenia drug.

The stock has cooled off since and is up just shy of 4% over the past week, but it has been on a serious tear over the past few months with a nearly 23% gain since July.

Cobenfy, the drug in question, was previously known as KarXT. It’s been referred to as a groundbreaking method for treating this disease since it falls under the umbrella of muscarinic receptor agonists, an emerging drug class.

What makes it unique from other drugs Americans use to treat schizophrenia is a lack of serious side effects associated with other drugs, such as Thorazine and Seroquel.

These are notorious for producing symptoms so severe that patients end up refusing their medication – like drowsiness, muscle tremors, and weight gain.

But since Cobenfy doesn’t work under the same pathway of broadly blocking dopamine receptors, it doesn’t produce these effects. It showed none of these issues in clinical trials.

Further to that point the Bristol Myers drug is the only antipsychotic that doesn’t have a black box warning, which is the FDA’s strongest warning. It’s applied to a drug that has a serious risk of adverse effects.

This is part of what analysts and investors alike were watching for leading into the FDA review process. But it’s been a pleasant surprise, and analysts are bullish that this drug could transform the treatment landscape with better results and fewer side effects.

Bristol Myers is ahead in the race to get a drug like this to market, but competitor AbbVie is working on its own treatment that some believe will have an even greater safety profile.

Neurocrine Biosciences is also developing a drug of this caliber, but with Bristol Myers having a 2-3 year headstart over the competition, all eyes are on Cobenfy right now.

The financial potential for this drug has earned BMY a buy rating. With a potential list price of $1,850 a month and nearly 3 million affected individuals in the US alone, the treatment could deliver a tangible lift to the company’s revenues.

The drugmaker expects its treatment to hit shelves in October. So, where does this leave you? Is now a good time to buy BMY? We’ve taken a look at the VectorVest stock software and see 3 reasons to consider it.

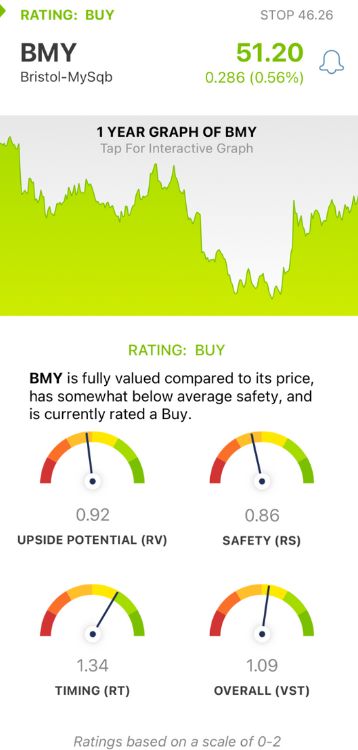

BMY Has Fair Upside Potential and Safety With Very Good Timing

VectorVest is a proprietary stock rating system with a track record of success, outperforming the S&P 500 index by 10x over the past 20 years and counting. The best part is it does this while saving you time and stress by delivering clear, actionable insights in 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

It gets even better, though. You’re given a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s what you need to see for BMY:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a much better indicator than the typical comparison of price to value alone. BMY has a fair RV rating of 0.92.

- Fair Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.86 is fair for BMY.

- Very Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.34 is very good for BMY.

The overall VST rating of 1.09 is fair for BMY and it’s enough to earn the stock a BUY rating in the VectorVest system. But before you make your next move one way or the other, take a moment to look at this free stock analysis for BMY and capitalize to the fullest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. BMY has earned FDA approval for its groundbreaking schizophrenia drug and the financial implications of getting it to market could be huge for the company. The stock itself has fair upside potential and safety with very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment