Boeing (BA) saw a nearly 6% jump in stock price this week after the company resumed production of its 737 MAX jetliners following a seven-week strike. The production halt had put the company’s ability to meet its ambitious targets in jeopardy, leaving many investors concerned about Boeing’s financial stability. But with a backlog of more than 4,000 orders for the MAX, the restart is being seen as a promising step forward—especially since the 737 MAX is Boeing’s most important program.

However, the road ahead isn’t without bumps. The FAA has imposed a production cap of 38 MAX jets per month, far below Boeing’s target of 56. Analysts are now forecasting a much slower production ramp-up in 2025, with only 29 planes per month expected—well short of what’s needed to generate meaningful profits. On top of that, regulatory scrutiny and safety concerns—like the mid-flight door panel blowout earlier this year—continue to cloud the company’s reputation.

While the stock’s recent surge shows investor optimism, there’s still a lot of uncertainty regarding Boeing’s long-term performance. So, the question remains: Should you buy BA now while the stock is on the rise, or hold off until there’s more consistent growth?

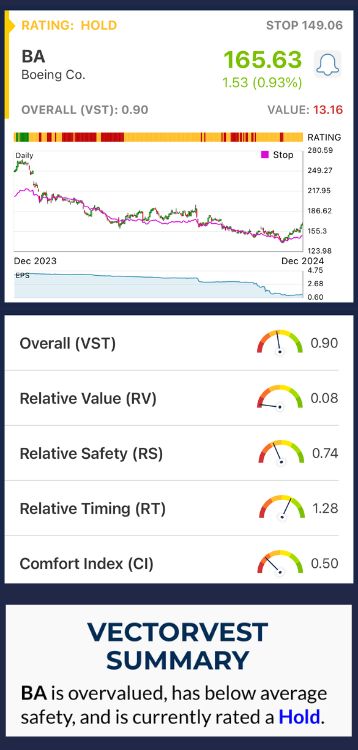

BA Has Poor Upside Potential, Poor Safety, and Strong Timing

VectorVest is a proprietary stock rating system designed to streamline your investment strategy, helping you win more trades with less work and stress. It does this by distilling complex technical and fundamental data into just 3 ratings, simplifying your approach to analysis.

These ratings are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy, but it gets even better.

The system issues a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. This eliminates any guesswork or emotion from your decision-making. As for BA, here’s what you need to know:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. BA has a poor RV rating of 0.08. Even after all the value it shed this year, BA is overvalued

- Poor Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.74 is also poor for BA.

- Strong Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.28 reflects strong investor optimism in the short term, driven by the restart of MAX production, but the long-term outlook remains uncertain.

The overall VST rating of 0.90 is fair for BA, but it’s not quite time to Buy this stock yet. It’s currently rated a HOLD in the VectorVest system. Take a moment to dig deeper with a free stock analysis at VectorVest and see for yourself how much simpler and more profitable investing can be!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. BA continues to face significant challenges. The company is at risk of being downgraded due to ongoing concerns about cash flow and production, especially with the lingering effects of the strike. Despite the recent surge in stock price, Boeing's upside potential remains weak, and its safety and timing ratings are far from ideal.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment