ASML (ASML) reported second-quarter earnings that surpassed Wall Street’s expectations on both the top and bottom lines and yet, the market responded by sending shares 10% lower.

The Dutch semiconductor manufacturer saw a surge in demand for the quarter, beating its original forecast and culminating in the following results:

- Sales: $6.79 billion vs $6.53 billion consensus.

- Earnings: $4.36 a share vs $4.03 a share consensus.

So, what’s the problem? These results suggest an impressive Q2 performance, however, it was actually a step backward for the company. In comparison to Q2 2023, net sales for this quarter fell 9.5% while net income dropped nearly 19%.

Still, ASML is one of the most prominent chip gear manufacturers in the world – it creates the tools necessary to produce the most advanced chips. The company also recognized a while back that 2024 would be a year of transition after a disappointing performance last year.

It left its outlook for the current quarter unchanged. The expectation is to deliver sales of $7.66 billion – but analysts had been forecasting $8.24 billion for Q3. This disconnect could be another contributing factor to the sliding stock price this morning.

However, ASML remains optimistic about the industry as a whole and its positioning. It recognizes that uncertainties are still present, but expects a better second half of the year that will carry over into 2024.

There’s also a great opportunity for the company to expand into AI – which currently makes up a very small portion of its sales.

ASML has now fallen 13% over the past week with today’s losses so far. But in the bigger picture, the stock has recovered well through 2024 thus far. It’s still up more than 30% on the year.

So, where does this leave current investors – should you hold your position and weather the storm or sell ASML? We’ve looked at this situation through the tried-and-true VectorVest stock software and found 3 things to help you make your decision either way.

No Need to Panic - ASML Still Has Good Upside Potential, Excellent Safety, and Fair Timing

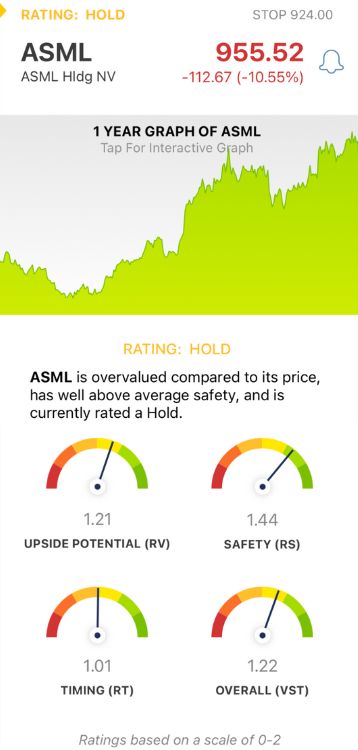

VectorVest simplifies your approach to stock analysis by giving you all the clear, actionable insights you need to make calculated, emotionless decisions in 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, which makes interpretation quick and easy. Better yet, the system issues a clear buy, sell, or hold recommendation for any given stock at any given time. Here’s what we found for ASML:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. This makes it a far superior indicator to the typical comparison of price to value alone. ASML has a good RV rating of 1.21.

- Excellent Safety: The RS rating is a risk indicator. It comes from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.44 is excellent for ASML.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.01 is fair for ASML.

The overall VST rating of 1.22 is good for ASML, and the stock is still rated a HOLD in the VectorVest system. Want to learn more about the current opportunity with this stock? A free stock analysis is just a click away to help you transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. ASML fell more than 10% Wednesday despite delivering a second-quarter performance that exceeded expectations on both the top and bottom lines. Still, the stock has good upside potential, very good safety, and fair timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment