By Leslie N. Masonson, MBA

Amphastar Pharmaceuticals Inc. (NASDAQ:AMPH), is a bio-pharmaceutical firm, that develops, manufactures, markets, and sells generic and proprietary injectable, inhalation, and intranasal products to its customers in the United States, China, and France. The company was incorporated in 1996 in Rancho Cucamonga, California where it is currently headquartered. It has $601 million in annual sales and a market capitalization of $2.76 billion with a roster of 1,615 full-time employees.

Andrew Krei, co-chief investment officer of Crescent Grove Advisors who was interviewed about biotech stocks in general said that: “Biotech stocks offer investors exposure to exciting innovations within healthcare and life sciences. These companies are often on the cutting edge and lead the development of breakthrough therapies. The upside can be substantial, but new technologies can fail to materialize, wiping out equity values.” In essence, he is saying to be careful buying these stocks and expect a wild ride.

Amphastar Inc. is probably not a well-known a name to most investors which is the same for most small to midsize biotech firms, but AMPH has landed the #1 ranking in both VectorVest’s Drug (Biomedical/Genetic) industry (out of 847 stocks), and the more broader Drug Sector (896 stocks). This is a noteworthy and remarkable achievement.

This sector contains four industry components and the Drug (Biomedical/Genetic) component ranks a lowly 207 out of 222 industries tracked which is in the bottom 10% of the pack. Therefore, AMPH has not only outpaced its competitors, but it is also a highly ranked VST stock (ranked 28th out of 9,141) that is performing the opposite of its industry. This is very unusual and attests to the stock’s positive fundamental and technical factors.

Moreover, 319 institutions hold 63.6% of their 47 million shares outstanding with management holding a significant 22% stake. Among the top three holders are Blackrock Inc. with 15%f the shares, Vanguard with 4%, and Dimensional Fund Advisors LLP with 4%. The interest in this company by so many institutions shows their interest in this growing company, and is another positive indicator of future potential. Also, there are five analysts covering the stock.

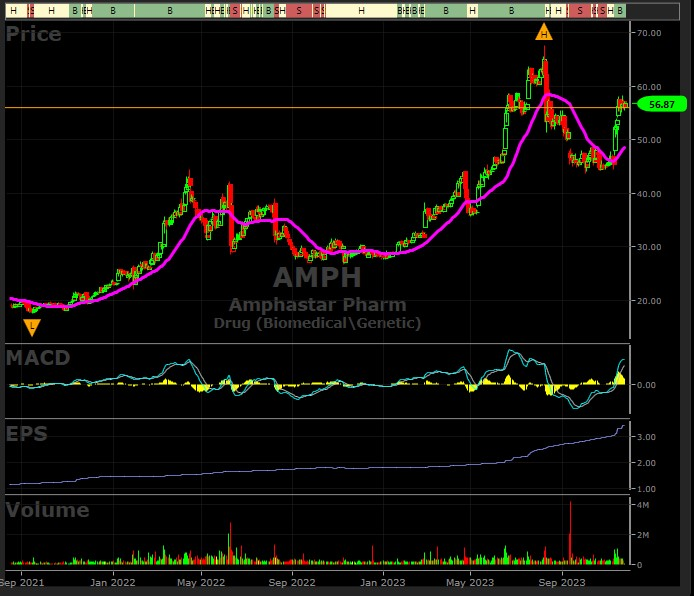

One cautionary factor is that the MACD has just started to curl downward, but so far it has not crossed to the downside yet. If that happens, then hold off on any purchase. However, on a positive note, its price is nicely above its 40-dma.The RSI (14) reading (not shown on the graph) is at 71.3, a high level, and a bit overbought, but nothing to be concerned about. So, caution is urged until a breakout above the recent seven-day consolidation pattern.

Amphastar Inc.’s Five “Excellent” Metric Ratings, August All-Time High, and Significant Undervaluation Are Positive Signs Going Forward

The VectorVest software issues buy, sell, or hold recommendations on 9,141 stocks. This proprietary stock rating system splits the data into three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each is measured on a scale of 0.00-2.00, with 1.00 being the average for quick and easy interpretation, and 2.00 being the best.

The VectorVest ratings for AMPH are as follows:

- Excellent Upside Potential: The Relative Value (RV) rating focuses on a stock’s long-term, three-year price appreciation potential. The current RV rating for AMPH is 1.61 which is exceptionally high. Moreover, VectorVest determined AMPH to be significantly undervalued with a calculated value of $80.63 that is a whopping 41.8% higher than its current price of $56.87.

- Excellent Safety: The Relative Safety (RS) rating is based on the company’s business longevity, financial predictability/consistency, debt-to-equity ratio, and additional risk parameters, including price volatility. Its RS rating of 1.41 is well above average, indicating less than average risk. Therefore, this stock can be considered by long-term conservative investors.

- Good Timing: The Relative Timing (RT) rating focuses on the price trend over the short, medium, and long term. The components include price direction, dynamics, and price magnitude of price changes over daily, weekly, quarterly, and yearly comparisons. AMPH has an above average RT rating of 1.4 compared to the average 0.96 RT of all the stocks in the database.

- Excellent Comfort Index: This index measures the consistency of a stock’s long-term resistance to severe and lengthy corrections. This index compares the individual stock to the fluctuation of the VectorVest Composite price. With a CI rating of 1.46, AMPH rating is exceptional and well above average. Therefore, this is another positive metric for all long-term conservative investors.

- Excellent Growth Rate (GRT): AMPH has annual sales of $601 million and a 29% forecasted growth rate measured over a forecasted three-year period which is exceptional. Moreover, its sales growth of 50% over the last year has been superb. These two outstanding fundamental factors provide evidence of a growing company on the path to future growth. Additionally, these factors are calculated in the VectorVest software, so you don’t have to try to find these numbers on other websites.

- Excellent VST Score: The VST Master Indicator ranks 9,141 stocks from high to low and brings to the top of the rankings those stocks with the highest VST scores. AMPH’s score is 1.38which is the top 0.2% of the entire database, quite an outstanding accomplishment. Using VST enables users to determine stocks that are performing much better than average, as well as the opportunity to find the cream of the crop with a few mouse clicks. AMPH certainly falls into that category.

With a multi-year positive EPS trend, and a current ROE of 22.7% compared to 10.8% for the pharmaceutical industry, this stock has all of the key characteristics of a long-term winner. Moreover, its Beta of 0.87 (which means it is 13% as volatile as the S&P 500 Index) is another plus for most investors with a lower risk tolerance. The average daily volume of 370,000 shares is certainly sufficient for traders looking for tight bid-to-ask spreads.

VectorVest currently rates AMPH a “Buy” since November 9 at $52.41. Considering the stock’s powerful 103% year-to-date advance from $28.02 to $56.87 as November 24, coupled with its increasing earnings, this stock should definitely be placed on investors’ watchlists. Look for a timely entry above $58.35 as the price breaks above its current seven-day trading range of $55.14 to $58.35. The Daily Color Guard “Confirmed Up” call on November 24 adds another level of positive market confirmation of a potentially rising market. Likewise, if the stock price reverses below $55.14, then no action should be taken until any downdraft has subsided and the price begins to stabilize and move higher.

You can easily check out VectorVest’s future ratings on this stock before making any move. Analyze AMPH free using VectorVest to determine the current recommendation which can change at any time based on market conditions.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment