Advanced Micro Devices (AMD) reported its first-quarter earnings yesterday, which narrowly outperformed the analyst consensus. This lackluster performance coupled with a disappointing guidance has sent shares down more than 9%.

The chip maker posted earnings per share of 62 cents compared to the estimate of 61 cents. Revenue came in at $5.47 billion compared to the $5.46 billion analysts were expecting. This was only a 2% improvement year over year.

While the initial reaction to Q1 performance was negative, it’s worth noting that this time last year AMD reported a net loss of $139 million (9 cents a share loss). This quarter was a massive turnaround with a net income of $123 million (7 cents a share).

The biggest contributor to the Q1 performance was an 80% growth in the Data Center segment, which produced $2.3 billion in sales. The MI300 series AI chips from this segment target the same use case as Nvidia’s graphics processing units. Key customers included Microsoft, Meta, and Oracle.

The segment that held the company back the most was its gaming unit, which saw a nearly 50% dip year over year to just $922 million. Meanwhile, the embedded segment saw a similar drop of 46% year over year.

Safe to say the company cut things pretty close in Q1 – which could be why it issued a more modest guidance for the current quarter at just $5.7 billion. This is right in line with what Wall Street is expecting and works out to 6% growth year over year.

That being said, AMD did lift its full-year guidance for AI chip sales to $4 billion from $3.5 billion. This shows the company has a ways to go before it can even be compared to the likes of Nvidia, though, which brought in $18.4 billion in sales for the first quarter alone this year, most of which is attributed to AI chips.

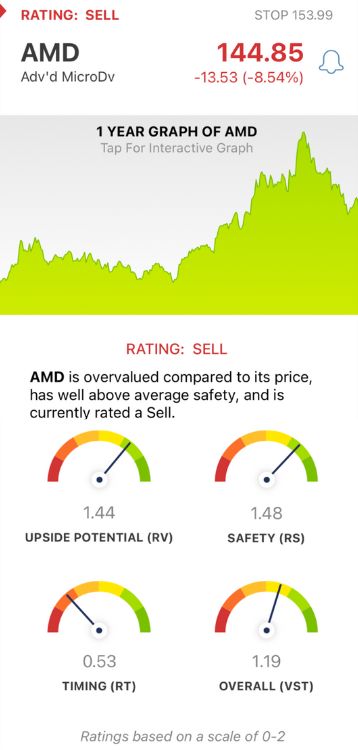

AMD has now dropped nearly 15% in the last 3 months, and today’s news is certainly not going to do anything to reverse that trend. This begs the question – is it time to cut losses on this stock? We think so after discovering a few red flags through the VectorVest stocks software.

AMD Still Has Excellent Upside Potential and Safety, But Timing is Very Poor for This Stock

VectorVest is a proprietary stock rating system that helps you win more trades with less work. It delivers clear, actionable insights in just 3 ratings - relative value (RV), relative safety (RS), and relative timing (RT).

Interpreting these ratings is quick and easy as each sits on a scale of 0.00-2.00 with 1.00 being the average. Just pick safe, undervalued stocks rising in price! Or, better yet, follow the buy, sell, or hold recommendation the system offers for any given stock at any given time based on its overall VST rating. Here’s what we found for AMD:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a far superior indicator than the typical comparison of price to value alone. AMD still has an excellent RV rating of 1.44. However, it’s worth noting the stock is overvalued. Its current value is just $103.30.

- Excellent Safety: The RS rating is a risk indicator. It’s calculated from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.48 is excellent for AMD.

- Very Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. This is where the concern is for investors, as the RT rating of 0.53 is poor for AMD.

The overall VST rating of 1.19 is good for AMD, but the strong negative price trend pushing the stock lower and lower has resulted in a SELL Warning for investors.

So before you do anything else, take a moment to look at this free stock analysis if you’re invested in AMD and make your next move with complete confidence!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. AMD delivered a slightly underwhelming Q1 performance, narrowly outperforming the analyst expectation on the top and bottom line. However, the real issue is the disappointing guidance going forward, which sent the stock down 9% today. While it still has excellent upside potential and safety, the timing is poor for this stock.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment