This morning Alibaba (BABA) announced that they are playing musical chairs with the leadership group, as existing members within the company are swapping roles. All of this comes as the company works towards its restructuring goal of splitting the businesses into 6 distinct groups.

Long-standing CEO and chairman Daniel Zhang is going to transition away from the role and dedicate his focus to the cloud division. He’s already been serving as head of the cloud unit since December. Zhang was forced into the role after the cloud unit fell victim to a major outage. And since then, he’s been wearing 3 different hats – it was time to narrow his focus.

It’s being said that Zhang’s appointment to the cloud division is a vote of confidence, as this segment is arguably the most important to Alibaba. Zhang has proven his worth since joining the company more than 16 years ago as an accountant, moving up the ranks since then.

The company expects to list the cloud unit as its own publicly traded company in a year or less. It’s been said that this business could be worth as much as $60 billion. But, there is some concern that the specific data managed under the cloud unit could put the business right in the sights of regulators.

Now, the chairman of Alibaba’s Taobao and Tmall Group will take over as CEO of Alibaba – Eddie Yongming Wu. In the meantime, Zhang’s chairman role will be passed off to Executive Vice Chairman Joseph Tsai.

This news – while in theory, a step in the right direction – has sent shares of BABA 5% lower so far in Tuesday morning’s trading session. Before this, though, the stock was rallying in the right direction – climbing nearly 8% in the last month before falling back to earth today.

That being said, what does all this mean for you as an investor or speculative trader? We’ve analyzed the stock through the VectorVest stock forecasting software and have 3 things you need to see before you do anything else.

While BABA Has Fair Safety and Timing, the Upside Potential is Poor

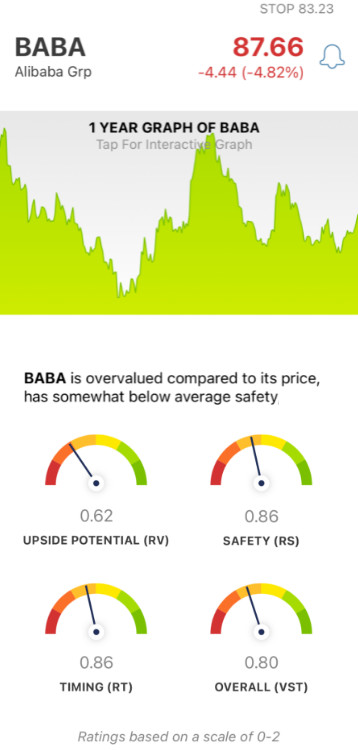

The VectorVest system uses 3 simple ratings to give you all the insights you need to make clear, confident decisions in the stock market. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00, with 1.00 being the average. By picking stocks with ratings appreciating above the average, you can win more trades with less work and less stress. Or, better yet, follow the buy, sell, or hold recommendation the system offers based on these ratings. As for BABA, here’s what we see right now:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (projected 3 years out) to AAA corporate bond rates and risk. And right now, BABA has a poor RV rating of 0.62. This stock is overvalued, too, with a current value of just $48.67.

- Fair Safety: The RS is an indicator of risk, calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity. And right now, the company has an RS rating of 0.86 - which is a ways below the average of 1.00, but deemed fair nonetheless.

- Fair Timing: While the stock was rallying leading into today’s news, that trend has more or less been squashed. Still, the RT rating of 0.85 is fair - albeit below the average. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.80 is poor for BABA. Does that mean you should rush to sell off your position if you’re currently holding this stock? Not so fast. Get a clear buy, sell, or hold recommendation today to make your next move without any guesswork or emotion. A free stock analysis awaits you at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While Alibaba’s restructuring efforts should be seen as a good thing, the initial reaction was negative. The stock has fair safety and timing, but the upside potential is poor.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment