Albemarle (ALB) dropped more than 3% to start Wednesday’s trading session after announcing its efforts to cut costs in response to plummeting lithium prices. Shares have since recovered and are now down just over 1%.

The American chemicals manufacturing company is on a mission to lower its costs by nearly $100 million annually, and it’s looking to achieve half of that this year alone. Step one? Layoffs.

Albemarle won’t disclose the number of jobs it cut from its workforce, but there’s reason to believe it’s substantial. After all, the goal is to free up $750 million in cash flow in the near term through these measures. Beyond slashing its internal workforce, the company is also decreasing its spending on contracted services.

There will also be a sizable drop in capital expenditures on the road ahead. Last year, the company jotted $2.1 billion in capex. This year, the target is a modest $1.6 billion to $1.8 billion. Albemarle is narrowing its focus to just projects that are well underway and near completion or in start-up.

CEO Kent Masters says that these actions are all necessary for not just the advancement of near-term goals, but also to preserve future opportunities amidst a challenging economic environment.

And, what a challenging economic environment it is for the company, which relies heavily on lithium sales. Prices of lithium have fallen off a cliff over the past year, as demand isn’t growing anywhere near the pace of supply. Lithium hydroxide futures are down more than 80%.

ALB has now seen its value cut by nearly 50% in the past year. The stock has lost 16% in the past month alone. So, where does all this leave investors? Will it be enough to save the company, or is the writing on the wall?

We’ve analyzed the current state of this stock through the VectorVest stock forecasting software. There are 3 things you need to see right now…

ALB Still Has Very Good Upside Potential and Fair Safety, But the Timing is Poor For This Stock

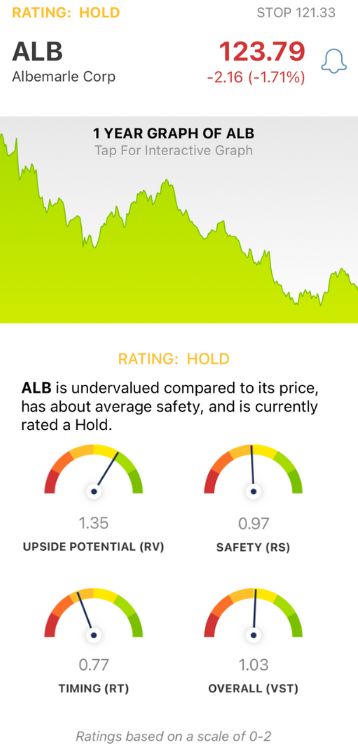

VectorVest simplifies your trading strategy by giving you clear, actionable insights in just 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each rating sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

But, it gets even easier. VectorVest gives you a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for ALB, here’s what we found:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection) to AAA corporate bond rates and risk. It offers much better insight than a simple comparison of price to value alone. ALB has a very good RV rating of 1.35 right now. The stock is undervalued with a current value of $175.89.

- Fair Safety: ALB may be struggling, but it’s still a fairly safe stock with an RS rating just below the average at 0.97. This risk indicator is computed through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors.

- Poor Timing: The biggest issue for ALB right now is the strong negative price trend that has gripped the stock for the past year and counting. The RT rating of 0.77 is poor and reflects this performance. The rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.03 is considered fair. ALB is currently rated a HOLD in the VectorVest system. We encourage you to learn more about this opportunity through a free stock analysis today. Start making more confident, calculated decisions and transform your trading strategy with VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. ALB is down today as challenges regarding falling lithium prices mount. The company has responded with dramatic cost-cutting measures. While the stock does have very good upside potential and fair safety, poor timing is holding it back.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment