Affirm Holdings (AFRM) has been generating buzz lately after sharing its fiscal first-quarter earnings, which came in above expectations for several key metrics. However, the stock dipped over 6% in early trading as investors processed the news.

In the latest earnings report, Affirm announced impressive revenue of $698 million, representing a significant 41% increase year-over-year, and comfortably exceeding the analyst consensus of $664 million. Although the company reported a net loss of $100 million, or 31 cents per share, this was better than the anticipated loss of $108 million. Gross merchandise volume (GMV) also saw a substantial rise, hitting $7.6 billion, up 35% from the previous year and surpassing expectations of $7.28 billion. Plus, active consumers increased by 15%, indicating strong adoption of Affirm’s services.

Looking ahead, Affirm expects its second-quarter revenue to be between $770 million and $810 million, with Gross Merchandise Value projected at $9.35 billion to $9.75 billion. The company remains optimistic about reaching profitability by the fourth quarter of fiscal 2025, signaling a positive growth outlook in the competitive buy now, pay later landscape.

Affirm Holdings Has Good Upside Potential With Fair Safety and Timing

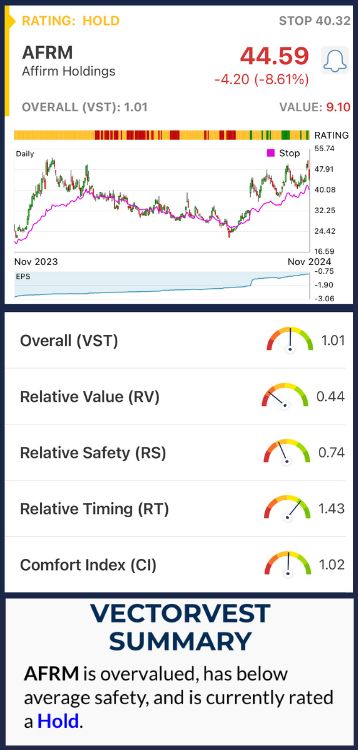

VectorVest is a proprietary stock rating system that provides critical insights to help investors make informed decisions. The ratings are based on three key indicators: relative value (RV), relative safety (RS), and relative timing (RT), each scaled from 0.00 to 2.00, with 1.00 as the average.

Here’s what you need to know for AFRM:

- Poor Upside Potential: The RV rating measures a stock’s long-term price appreciation potential, and AFRM has an RV of 0.44, indicating that the stock may struggle to grow significantly over the next few years.

- Poor Safety: The RS rating, which reflects the risk level of the stock, stands at 0.74 for AFRM. This suggests that the company’s financial performance may be inconsistent compared to its peers, adding a layer of caution for investors.

- Excellent Timing: In contrast, the RT rating is strong at 1.43, indicating positive momentum in the stock's price movements. This suggests that, despite valuation concerns, the market may favor Affirm's short-term performance.

The overall VST rating of 1.01 is fair for AFRM, and the stock is currently rated a HOLD. While Affirm has demonstrated impressive growth in key areas, the current valuation and safety ratings warrant careful consideration before making investment decisions.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest focuses on identifying safe, undervalued stocks with strong growth potential. While AFRM has shown impressive growth in revenue and GMV, the current valuation raises some concerns.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment