Shares of Nio Inc. (NIO) started Monday morning on a solid note, gaining 8% in pre-market trading before settling at around a 5% gain when the market opened.

This came after the electric vehicle manufacturer released a statement that it had received a $2.2 billion investment. The cash infusion came from Abu Dhabi investor CYVN, who has purchased 294 million shares at $7.50 each. The stock now sits at $8.34/share.

CYVN has been bullish on NIO for some time now. Today’s news follows a $738.5 million investment back in July along with $350 million worth of shares from Tencent. The group now boasts a 20% stake in the EV company. This means it has the power to appoint two directors to the company’s board.

Nio’s founder, chairman, and CEO William Li spoke to this news and said his company is better positioned than ever before thanks to this boost to the balance sheet. The company can offer better sales and service while honing in on branding. And, this cash infusion will empower Nio to invest in core technologies that will pay dividends in the long term.

The company has been the closest competitor to Tesla for a while. It’s cut jobs and projects to sharpen its operational efficiency and focus on what actually makes the company money.

NIO has plummeted from its January 2021 high of nearly $62 per share. But, it’s been rallying back in the right direction over the past month and now sits 14% higher in that span. This begs the question, should you follow suit and invest in NIO yourself?

We’ve taken a look at this opportunity through the VectorVest stock analysis software and uncovered 3 things you need to see before making your next move.

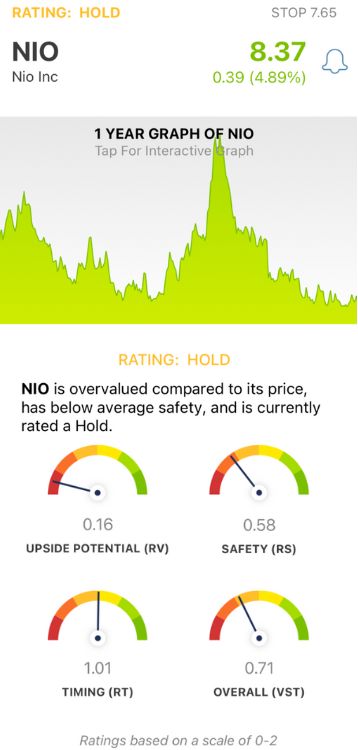

NIO Has Very Poor Upside Potential and Poor Safety, But the Stock’s Timing is Fair Right Now

VectorVest is a proprietary stock rating system that simplifies your trading strategy. You’re given all the insights you need to make calculated, emotionless decisions in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. It gets even easier though. You’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for NIO, here’s what you need to know:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. This offers much better insight than a simple comparison of price to value alone. NIO has a very poor RV rating of 0.16 right now. Even at its current price it’s overvalued, with a current value of $1.08/share.

- Poor Safety: The RS rating is an indicator of risk. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. NIO has a poor RS rating of 0.58 right now.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. Despite the trend we’ve seen forming over the past few weeks, NIO’s timing is just fair now - with an RT rating of 1.01.

The overall VST rating of 0.71 is poor, but VectorVest has rated the stock a HOLD for the time being. We encourage you to stay up to date on NIO and learn more about the VectorVest system through a free stock analysis!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. NIO received a $2.2 billion investment from CYVN, a group in Abu Dhabi. This sent shares 5% higher on Monday. However, the stock still has very poor upside potential and poor safety despite fair timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment