Netflix shares (NFLX) have gained more than 46% through 2024 thus far, and the streaming giant’s stock has gained 4% in the past month alone. However, there are concerns as to whether or not the company can continue to grow or not.

The company has given investors a look inside year-over-year (YoY) global engagement trends for the first time in its history through its biannual viewership report.

More than 94 billion hours of content were streamed in the first half of the year. It helps that Netflix added 39 million new subscribers from June 2023 to June 2024.

This can be traced back to the company’s crackdown on password sharing and the release of a new ad-supported tier at a more affordable price point.

For a while, all eyes were on the subscriber race between Netflix and Disney, but Netflix itself has come out and stated that subscribership is a less important metric than engagement – which analyzes the total number of viewing hours on the platform.

This is where some of the concern for NFLX in the long-term comes into play, as engagement looked to be fairly flat year over year, up just 1%. In fact, average daily hours viewed per subscriber actually decreased for the quarter to less than 2 hours, a 13% drop YoY.

A spokesperson for Netflix says the company has no concerns, though, and that engagement is at a healthy, sustainable level. Some experts remain skeptical about growth potential for the long run, though.

Netflix also has the lowest churn compared to its peers, even though that metric has been climbing a bit over the past few months.

The company is set to declare third-quarter earnings on October 17, for which analysts are expecting revenue growth of at least 15% and earnings growth of 40%.

So, where does that leave you as a current investor – should you buy NFLX in advance and hopefully benefit from a post-earnings bump? Or, is this the ceiling for NFLX? We found 3 things you need to see in the VectorVest stock software before you make your decision.

NFLX Has Excellent Upside Potential and Safety With Good Timing

VectorVest is a proprietary stock rating system that distills complex technical and fundamental data into clear, actionable insights in just 3 simple ratings. This saves you time and stress while empowering you to win more trades.

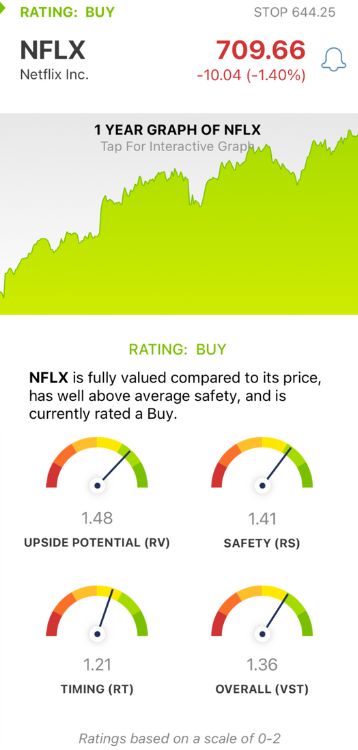

The ratings are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

It gets even better, though. You’re given a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for NFLX, here’s what we found:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. NFLX has an excellent RV rating of 1.48.

- Excellent Safety: The RS rating is a risk indicator computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.41 is also excellent for NFLX.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.21 is good for NFLX, reflecting its performance throughout this year.

The overall VST rating of 1.36 is very good for NFLX, and the stock is rated a BUY in the VectorVest system. But before you make that next move, review this free stock analysis for deeper insights and set yourself up for a profitable, stress-free trade!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. NFLX has been climbing higher and higher through 2024, and while there are some concerns about engagement growth, the stock still has excellent upside potential and safety with good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment