The Facebook parent company Meta (META) reported second-quarter earnings results that came in well above analyst expectations, sending shares climbing 5% higher so far Thursday morning. Here’s how the company fared:

- Earnings: $5.16 per share compared to $4.80 consensus

- Revenue: $39 billion compared to $38.3 billion consensus

This worked out to a 73% and 22% improvement in earnings and revenue respectively – and yet, costs only grew by 7%. Operating profit was up to 38% in June 2024.

Just last April the company faced backlash for its AI investments, which initially sent shares 12% lower. But Meta AI is now forecasted to be the most used assistant in the world by the end of the year according to CEO Mark Zuckerberg.

The Facebook platform itself thrived as well. Daily active users saw 7% growth from this time last year, while ad impressions and prices were both up 10% as well.

Advertising is everything for Meta, and it’s gotten a massive lift as more and more companies shift their spending away from traditional TV advertising. The Olympics and the presidential election are both playing a part in the uptick in spending.

But, the company’s ad delivery has improved as well according to CFO Susan Li. Apple’s “privacy measures” associated with iOS 14 made it difficult to effectively target users, but Meta says its targeting and serving enhancements have led to a 22% return on ad spending (ROAS).

Looking ahead to the September quarter Meta is now forecasting a revenue range of $38.5 billion to $41 billion, which would work out to 24% growth year over year. Analysts were only hoping for 15%.

As many big tech companies are seeing their stocks falling, META is now up nearly 9% this week, adding to the impressive rally it’s been on so far this year. The stock is now up 44% through 2024.

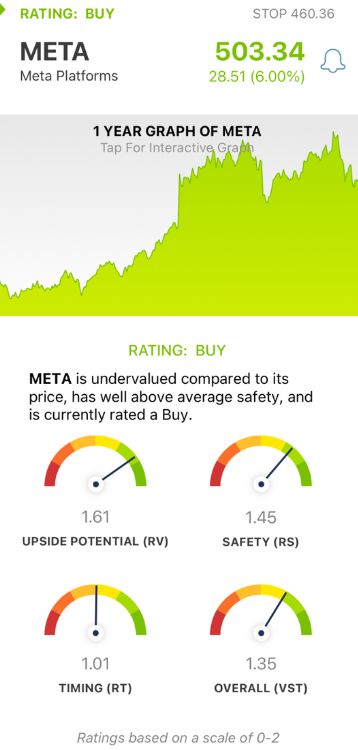

We’ve taken a closer look at META through the VectorVest stock analysis software and see 3 other reasons to buy this stock, too. Here’s what you need to know:

META Has Excellent Upside Potential and Safety With Fair Timing

VectorVest is a proprietary stock rating system designed to save you time and stress while helping you earn higher returns. It does this by distilling complex technical and fundamental data into 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. Better yet, the system issues a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s an overview of META:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a much better indicator than the typical comparison of price to value alone. META has an excellent RV rating of 1.61 and appears to be undervalued. Its current value is $603.31.

- Excellent Safety: The RS rating is a risk indicator. It’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.45 is excellent for META.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.01 is just fair for META right now, but as the stock continues its rally, this will continue to climb.

The overall VST rating of 1.35 is very good for META and enough to earn the stock a BUY recommendation in the VectorVest system. But before you make your next move, take a closer look at this opportunity with a free stock analysis at VectorVest to fully capitalize!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. META is up 6% so far Thursday after reporting Q2 earnings and revenue that blew the analyst expectations out of the water, along with a very optimistic Q3 revenue outlook. The stock itself has excellent upside potential and safety with fair timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment