Want to learn how the stock market works? In this in-depth guide, the truth about the stock market will be revealed. You’ll learn about what actually affects the big picture of the stock market – and the role market sentiment plays in how the stock market works.

Any time a bear market is on the horizon, a self-actualizing prophecy begins. Financial analysts with a voice spread their pessimistic viewpoint – despite favorable market conditions still persisting.

But, this sentiment being pushed to the masses results in a negative investor sentiment taking hold. The end result? The S&P 500 starts dropping – not because the economy is falling apart. But rather, because people thought it would.

We’re going to guide you through the basics of how the market works below. You’ll learn what drives the market – earnings, inflation, and interest rates. Then, we’ll explain how market sentiment is intertwined with these technical factors to produce changes in the economy.

Most importantly? You’ll learn how to navigate the market with confidence using the best stock analysis app, VectorVest. It saves you time and stress by telling you what to buy, when to buy it, and when to sell it – eliminating any guesswork, emotion, and uncertainty from your decision-making.

The stock trading system has outperformed the S&P 500 index by 10x over the past 20 years and counting, too, so you can rest assured it works. See the best investment apps for beginners in action today!

Understanding How the Stock Market Works at a Broad Level

Before we can take a deep dive into how the stock market works, we want to explain it at a more broad level. That means we need to take a step backward – and explain what a stock is.

Overview of Stocks

A stock is a financial instrument that represents ownership in a company. When you buy stock, you gain ownership of the said company. It’s that simple.

But what does owning a stock mean, really? Are you going to have a say in the daily happenings at the company? Will you be invited to the annual Christmas party?

Not necessarily. Most major companies on the stock market exchange have outstanding shares that run into the billions. Becoming a majority shareholder in any publicly traded company is rare these days.

However, owning company stock does mean that you benefit from the increased valuation of that company. As the price goes up over time, your shares are worth more.

But, the opposite is true, too. Should a company’s stock price fall, your investment will dwindle. It’s important to understand the risk you take on when investing in the stock market. But, that’s a conversation for another day.

Why Do Companies Issue Stock?

Companies issue stock primarily as a means to raise capital. This could be for anything from expanding business ventures, funding new projects, reducing debt, or enhancing infrastructure. Here are all the reasons companies typically go public:

- Growth and Expansion: Issuing stock can provide the necessary funds for a company to grow and expand. This might include entering new markets, developing new products, or acquiring other businesses.

- Enhancing Liquidity: Selling stock increases a company’s liquidity, giving it access to cash that can be used for daily operations and strategic moves without the pressure of immediate repayment, unlike traditional loans.

- Shareholder Base: Issuing stock helps a company build its shareholder base, spreading risk among a wider group of investors. This can also enhance its visibility and reputation in the market.

- Employee Incentives: Companies often use stock as part of compensation packages to attract and retain top talent. Stock options and equity stakes align employees’ interests with the company’s success, potentially driving productivity and innovation.

The Stock Market Explained in Just a Few Paragraphs

Now, we want to help you gain a better understanding of how the stock market works at a broad level. The stock market is simply an exchange where investors like yourself can purchase or sell shares of company stock.

It’s an auction-based system where buyers and sellers set their own prices. And, the specific price of a given stock is derived largely from value as we discuss in our guide on what drives stock prices.

Because investors may not agree on the specific value of a given stock, fluctuations in price on a minute-by-minute basis are common. You can purchase a stock at one price, and sell it at a higher or lower price a few hours later.

But what causes these changes in price? What are the inner workings of the stock market, and how do they affect our economy as a whole? That’s really what we’re interested in discussing today. Before we go any further though, let’s talk about the different types of stock markets.

Different Types of Stock Exchanges

Most people talk about the “stock market” in a general sense as if there is only one single market. That’s not the case. There are quite a few different types of stock exchanges you need to be aware of:

- Primary Exchange: This is where new issues of stocks and other securities are sold to the public through initial public offerings (IPOs). The primary market facilitates the capital-raising activities of issuers looking to enter the public market.

- Secondary Exchange: After securities are initially issued in the primary market, they are traded among investors on the secondary market. This exchange does not involve the issuing companies directly; instead, it offers a platform for buying and selling securities among investors.

- Electronic Exchanges: These are modern stock exchanges where all trading is done electronically without the need for a physical trading floor. They use electronic trading platforms that automatically match buyers and sellers, which increases the efficiency and speed of transactions.

- Over-the-Counter (OTC) Markets: Unlike formal exchanges, OTC markets are decentralized and lack a central physical location. Stocks that trade via OTC are typically those of smaller or newer companies that don’t yet meet the criteria to be listed on larger exchanges.

Most Popular Stock Exchanges

You likely are familiar with the New York Stock Exchange (NYSE) or the NASDAQ – but there are hundreds of stock exchanges, each of which plays a role in how the market works as a whole:

- New York Stock Exchange (NYSE): Located in New York City, the NYSE is one of the largest stock exchanges in the world by market capitalization. Known for its strict listing requirements, the NYSE hosts some of the world’s largest and most well-established companies.

- NASDAQ: Specializing in high-tech companies, NASDAQ is known for its electronic trading system. It ranks just behind the NYSE in terms of market capitalization and is favored by technology giants such as Apple, Amazon, and Google’s parent company, Alphabet.

- London Stock Exchange (LSE): One of the oldest stock exchanges in the world, the LSE continues to be a central hub for international investors and companies wanting to expand their reach globally.

- Tokyo Stock Exchange (TSE): As the heart of the Asian financial market, the TSE hosts some of Japan’s largest companies, playing a crucial role in the economic activities of the Asia-Pacific region.

- Shanghai Stock Exchange (SSE): Reflecting China’s significant economic growth, the SSE is noted for its rapid expansion and is central to mainland China’s financial markets.

Other Assets Traded on the Market Beyond Stocks

We know you came here to learn how the STOCK market works – but stocks themselves are just one piece of the puzzle. The financial markets offer a diverse array of other assets that can enhance investment portfolios and provide additional opportunities for profit and diversification:

- Bonds: These are debt securities issued by corporations, municipalities, states, and sovereign governments to finance projects and operations. Investors lend money for a defined period at a fixed interest rate, making bonds a popular choice for those seeking steady income.

- Mutual Funds: These investment vehicles pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities, managed by professional money managers.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, ETFs are collections of stocks, bonds, or other assets. However, they trade on stock exchanges similar to individual stocks, offering flexibility and ease of trading.

- Commodities: These include physical resources like oil, gold, and agricultural products. Commodities can be traded through futures contracts on commodity exchanges, providing a hedge against inflation or sector-specific exposure.

- Derivatives: Including options and futures, derivatives are financial instruments whose value is derived from an underlying asset. They are used for hedging risks or speculation on price movements of the underlying asset.

Understanding the Role of Brokers

The way you as a retail investor actually interact with the stock market relies upon brokers. These facilitate the actual buying and selling of stocks and other securities.

Some brokers even offer additional services like research, investment advice, and wealth management. But you don’t need a financial advisor, you can do most of this yourself with the VectorVest system.

That being said, you do need a good broker. Consider factors such as commission rates, available services, the ease of use of the trading platform, and the level of customer support.

Brokers are regulated by governmental and independent regulatory bodies that ensure they adhere to legal and ethical standards. Understanding the protections offered by a broker, including insurance schemes like the Securities Investor Protection Corporation (SIPC) in the U.S., can provide additional security to investors.

There are tons of choices at your disposal, from something as simple as the Robinhood app to TradeStation, Questrade, and InteractiveBrokers – these last three can be directly integrated with VectorVest for a comprehensive stock analysis and trading system.

A Deeper Look at How the Stock Market Works

If you came here hoping to gain an in-depth understanding of what affects the stock market and truly drives prices up and down, you’ve come to the right place. Here’s a brief overview of what we’ll cover in the coming sections:

- The technical factors that cause value to rise or fall in the stock market (earnings, interest rates, and inflation)

- The market conditions that create the best opportunity for investors

- The role market sentiment plays in influencing the stock market

What Technical Factors Causes Value to Rise or Fall in the Stock Market?

First, to truly explain the stock market, we have to talk about what causes the value to rise or fall. There are three factors that we want to highlight.

- Earnings

- Inflation

- Interest rates

First, we have earnings. Earnings are the most prevalent driving force for the stock market. We have an entire guide on what earnings is in the stock market.

But, to summarize, this is a metric that shows you how profitable a company is in a given period. When a company’s earnings exceed expectations, the perceived value of that company rises – and so too does the stock price. On the other hand, when poor earnings reports are released, value and price fall.

But, earnings don’t paint the whole picture in the stock market. There are two external forces that will dictate where we see a bull market (favorable) or a bear market (unfavorable): inflation and interest rates. We recently wrote a complete guide on what inflation does to the stock market.

We also discussed how to hedge against inflation, and provided insights into the best hedge against inflation for these periods. But to summarize, rising inflation is typically an indicator of a bear market. As inflation goes up, stock prices go down. The opposite is true as inflation goes down.

Similarly, interest rates have a unique relationship with the stock market. While they are not necessarily directly related to each other, the stock market and interest rates share an inverse relationship. History has shown that as interest rates rise, stock value goes down.

Rising interest rates contribute to a bear market. On the other hand, as the fed lowers interest rates, stock value goes up.

What Market Conditions Create the Best Opportunity for Investors?

Now, having explained the three factors affecting the overall stock market – what conditions create the best opportunity for investors? We’ve tiptoed around the answer a bit – but here’s what you need to know:

As earnings increase and inflation & interest rates drop, the stock value increases. If any of these factors deviate, the stock market will turn.

So, if earnings continue to increase but inflation and interest rates start to rise as well, the stock value drops. Or, if earnings drop while inflation and interest rates stay consistent, the stock value will still drop.

The point is, you need these three factors to remain in harmony for favorable conditions to persist. We were fortunate enough to witness (and take advantage of) one of the largest bull runs in history – from 2009 to just recently with the COVID-19 pandemic.

In summary – invest in periods of time where earnings, inflation, and interest rates are optimal and you’ll have success. Now, that’s not to say you can’t see periods of profitability in unfavorable stock market conditions. So, should you buy stocks when they are down? Is investing in a down market ever a good idea?

With swing trading strategies and market timing strategies, you can capitalize on short-term price swings and make a killing. The same is true of shorting a stock, or purchasing inverse ETFs. You can even learn how to invest in a recession to preserve your portfolio – or, perhaps even continue to earn profits!

Investor Sentiment in the Stock Market Trumps Technical Factors

Now that you know the main three factors affecting the stock market and how they’re interconnected, it’s time to add one more layer of complexity: investor sentiment.

As we detailed in our guide covering what stock market sentiment is, this is a gauge of how other investors in the market feel at any given time.

And as you may already know, perception becomes reality in the stock market. If investors have a negative outlook on the stock market at large and suspect a bear market is coming, this will manifest itself.

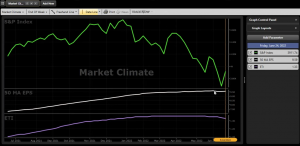

Just take a look at our current market climate charted against EPS. You’ll see that while EPS (earnings per share) have slowed, they have not started trending down. So, why are we seeing a bear market come to fruition? Investor sentiment!

The financial professionals in the industry with a voice are all calling for a bear market. They have the ability to move the market with this sentiment. Earlier, we said that earnings drive the market. And to a certain extent, that’s true.

But investor sentiment trumps logic and facts. Because inflation and interest rates are suggesting a bear market could come in the future, people are jumping the gun and behaving as if a bear market is already upon us. This is leading to the current volatility we are experiencing.

With an Understanding of How the Stock Market Works, How Can You Be Successful as an Investor?

That just about concludes our explanation of how the stock market works. But, chances are, you’re now left more bewildered than before reading this article.

You know now that you can stay on top of every stock indicator – but there would still be factors you aren’t taking into account in the form of investor sentiment.

That’s why you need the help of a stock analysis software to eliminate guesswork, tune out the noise, and grant you clear insights into whether you should remain in the market or pull out.

At VectorVest, we’ve simplified investing for you with the best stock apps for iPhone and the best stock apps android. You can gain clear insights into investor sentiment at any given time right from your dashboard.

And, we even give you a clear buy, sell, or hold recommendation for any given stock – at any given time. No more emotion in your decision-making, no more guessing games. Just trust the VectorVest system and start winning more trades on autopilot.

We even help you identify opportunities with ease. Just pull up our list of hot stocks, pick the ones we’ve ranked the highest, and time your entry/exit to perfection.

You can find the best stocks to buy for beginners, the best blue chip dividend stocks, the best aggressive growth stocks, high volatility stocks, falling stocks to buy, current undervalued stocks, you name it. No matter how you go about building a stock portfolio, this is the best stock picker available.

If you want to see what it looks like in action, take a look at our analysis for the most searched stocks here. Or, get a free stock analysis for any company on the market. We’re confident you’ll be hooked, and won’t want to go back to investing the old way.

Wrapping Up Our Overview of How the Market Works

That covers our breakdown of how the market works. We hope this deep dive into the inner workings of the stock market has granted you clarity. In summary:

- Earnings drive the market. Increasing earnings, coupled with low inflation and low-interest rates, creates optimal conditions for investors.

- Investor sentiment trumps facts and logic, and perception becomes reality. Investors need to track not just the technical elements of the stock market – but the emotional elements as well.

- With a software like VectorVest, making emotionless, calculated decisions is easy. You can trade in confidence with insights into current market sentiment – along with our unique value, safety, and timing metrics.

You can learn more about your next steps to starting investing in our blog. We have resources on the various stock investment strategies, like blue chip investing, dividend vs growth stocks, investing after retirement, how to pick a stock, how to buy the dip, when to buy stocks, when to sell stocks, free stock analysis websites, and more.

Otherwise, it’s time to give the best stock research website a try today now that you know how the stock market works and take advantage of all it has to offer. VectorVest is ready to help you navigate the market with confidence and clarity!

Leave A Comment