Three Ways to Handle Inflation in the Stock Market Today

In the latest ESG & Tech show, I delved right into the theme as it is the conversation of the day, the week, and the year! First, it’s important to understand what drives inflation.

Three causes of inflation

“Demand-pull” inflation refers to when there is a greater demand than supply and as a result, the suppliers of those goods and services increase prices accordingly.

“Cost-push” inflation occurs because the price of the inputs a good or service being provided increases and this is passed on to the buyer.

“Built-in inflation” arises because people expect inflation to happen in the future and it’s woven into wage expectations and negotiations. This leads back to an influence on “demand-pull” and “cost-push” inflation in an ever-changing loop.

Global Inflation Rates

Inflation rates are making headlines right around the world with references to “multi-decade highs”. For example, according to Trading Economics, the latest inflation rates in various countries include:

United States: 8.5%

United Kingdom: 7%

Portugal: 5.3%

Australia: 3.5%

Brazil: 11.3%

So, as investors, how can we handle this? For a start, it’s important that we do as inflation eats into our purchasing power. The equity and bond markets look at this very differently. If I lend money to a government or company through a bond and they repay the money (as expected) in a year’s time, then my $100 or €100 is expected to buy fewer things. Specifically, if I lend $100 to the US government and it repays me $100 in a year’s time, my money will only be able to buy 91.5% of what it did when I lent it to them in the first place (based on the 8.5% inflation rate)! As a result, in periods of high inflation, the debt market tends to suffer from an exodus of money. However, the equity market is the place where higher risk is rewarded with higher returns over the longer term.

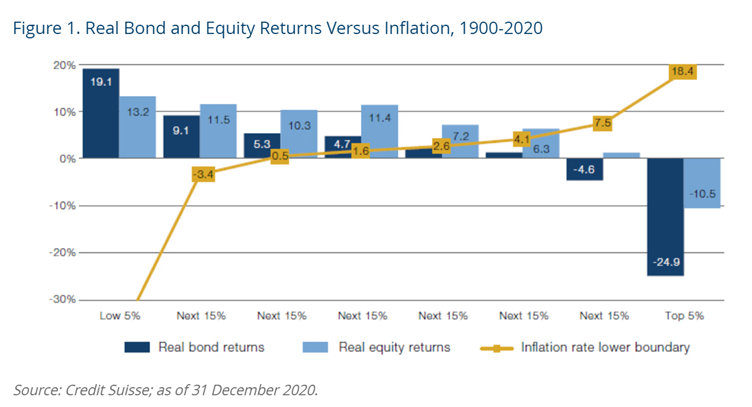

Credit Suisse points out the contrast in the above graph spanning 120 years. The column with the 7.5% inflation is particularly relevant at the moment. That said, the stock market has had a rocky start with the invasion of Ukraine, lower technology company earnings reports than expected as well as soaring inflation that central banks aren’t quite sure how to handle. For example, we saw that the iShares Global 100 ETF had a -5.06% return by 11th April. In the same timeframe, iShares Core S&P 500 ETF had delivered a -7.06% return. If we take a tailored approach, the iShares TIPS Bond ETF (which tracks a range of US Government Treasury Inflation-Protected Securities “which are government bonds whose face value rises with inflation”), the return is also negative at -4.77%. To add fuel to this fire, there was a Confirmed Call Down issued for the US market on the 12th of April. For all these reasons, the timeliness of this episode was all the more timely!

Three ways to handle inflation

There is an argument that sustainability and ESG investing are inflationary. In “How to Avoid a Climate Disaster”, Bill Gates posits that “Phasing out coal, oil, and gas and replacing them with renewable energy will be expensive; rolling out electric vehicles will be expensive; insulating homes and offices will be expensive. So, in short, the geranium is inherently inflationary: we must accept that in the short term at least, we are going to have to pay more to meet zero-carbon goals, and this will cause prices to rise.”

We can see this reflected in a variety of Clean Energy ETFs and particularly if we examine the performance of the theme in the past month.

The second way is to use a secret weapon in the VectorVest system. If we could identify one group of companies that has the outsized capability of absorbing inflation (and particularly in the short term), it is those with a high “NPM”. In other words, those businesses with a high net profit margin whereby there is some distance between what it costs to service their customers and how much those customers are paying for their goods and/or services. During the episode, I built a search in seconds whereby I could pick these companies right out of the database:

NPM > 2

Recommendation = Buy

Relative Safety > 1

Comfort Index > 1

This set of parameters generated a list of companies with very healthy net profit margins, above-average consistency, predictability of financial performance, and above-average ability to withstand severe and/or lengthy price declines as well as a buy recommendation. That’s a lot of criteria for a company to meet!

The resulting list of companies had delightful Relative Value (i.e. long-term price appreciation potential) and Relative Timing (direction, magnitude, and dynamics) levels. During the show, we analyzed their graphs over the past while and could clearly see the upward path they followed.

The third way leans on industry rotation. The following graph from Hartford Funds illustrates those areas which tend to react positively to rising prices.

It won’t surprise any viewers to see that energy and property are high on the agenda here given that they are the very manifestation of inflation in the real economy. Similarly, utilities and consumer staples, as the more defensive sectors, benefit from consumers being more thrifty.

VectorVest can add a lot of value when drilling down into these sectors for stock-specific ideas. The first thing to do is open your “Sector Viewer” and look for these areas. Double click to find the fastest-growing industries within them. (As a case in point, when you double click on “Energy”, you can find “Green Energy” stocks as an industry in that sector). If you double click again on the industry, you will find the comprising set of companies ranked in order of VST (Value Safety and Timing). You can amend that list into whatever categorization method you want from there (i.e. rank it by Earnings, Comfort Index, Relative Safety, etc).

Other Stock Ideas

There are lots and LOTS of articles all over the internet about how to combat inflation in this environment. I shared some examples in the episode and would always encourage you to put them through a VectorVest lens through the Stock Analysis report. Often these articles discuss free cash flow, production, reinvestment, etc. While these are useful business metrics, VectorVest really gets to the heart of whether these stocks align with your portfolio objectives i.e. whether they offer long-term price appreciation potential, have a PE ratio that you might be interested in, or how their earnings are growing.

Check out the full episode at https://www.youtube.com/watch?v=0DIFAddMk4E and ensure to subscribe to the channel so you will be automatically updated for our next ESG & Tech episode as well all other VectorVest live content.

Leave A Comment