Nissan Motor Co. (NSANY) surged 24% on Wednesday, marking its biggest single-day stock jump in 50 years, following reports of a potential merger with Honda Motor Co. Investors are abuzz, but is this the time to buy into Nissan?

The merger talks, which could also bring Mitsubishi Motors into the mix, aim to create an auto giant capable of selling over 8 million vehicles a year, putting it behind only Toyota and Volkswagen. By joining forces, the companies hope to pool resources, cut costs, and strengthen their position in the EV market. That said, bringing together different management styles and supply chains won’t be a walk in the park.

The market reaction has been swift. Nissan’s U.S. shares jumped 11.5% on Tuesday, with Mitsubishi Motors also seeing gains. Honda, on the other hand, slipped slightly as investors grappled with the potential financial strain of supporting Nissan.

While the buzz around the merger is promising, Nissan still faces tough challenges, including shrinking production, stiff competition in the EV space and a history of rocky partnerships. The merger may bring hope, but the road to success will be anything but smooth.

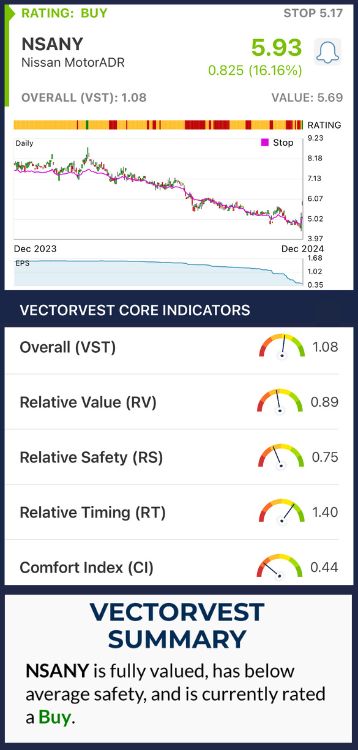

NSANY Has Fair Upside Potential and Poor Safety, But Good Timing is Pushing Prices Up

VectorVest helps take the guesswork out of investing by providing clear, actionable insights through three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00, with 1.00 being the average, making analysis straightforward. Additionally, VectorVest provides a buy, sell, or hold recommendation based on the overall VST rating for any given stock. Here’s what we found for NSANY:

- Fair Upside Potential: The RV rating assesses a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a much better indicator than the typical comparison of price to value alone. NSANY has a fair RV rating of 0.89.

- Poor Safety: The RS rating reflects a company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. NSANY has a poor RS rating of 0.75.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement, evaluated day over day, week over week, quarter over quarter, and year over year. Nissan’s RT rating of 1.40 reflects strong momentum following its recent surge.

The overall VST rating of 1.07 is fair for NSANY, earning the stock a Buy recommendation. While the recent surge in stock price reflects positive market sentiment, weak fundamentals and safety metrics suggest caution for long-term investors.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. NSANY surged on speculation of a potential merger with Honda, marking its largest single-day jump in 50 years. While the stock shows good timing thanks to recent momentum, its weak upside potential and poor safety raise concerns about its long-term prospects.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment