Nvidia (NVDA) stock has entered correction territory, falling roughly 14% from its November highs as concerns about AI spending and increasing competition weigh on investor sentiment. Shares dropped over 2% early Tuesday amid growing fears that Big Tech’s AI investments, which fueled Nvidia’s meteoric rise, may begin to taper.

Adding to the pressure, Microsoft’s CEO Satya Nadella recently commented on an “abundance” of chips following the initial AI boom, signaling that demand may stabilize. Meanwhile, regulators in China have launched an antitrust probe into Nvidia’s $7 billion acquisition of Mellanox, further contributing to investor caution. Despite these headwinds, Nvidia’s stock remains up 166% year-to-date, highlighting its dominant position in the AI chip market.

But with rising competition from Broadcom, Amazon, and others entering the AI chip space, should investors remain cautious, or is Nvidia still a stock worth holding? VectorVest’s analysis reveals key insights into NVDA’s current position and why it might still be worth considering.

NVDA Shows Excellent Safety but Weak Timing Right Now

VectorVest is a proprietary stock rating system that delivers clear, actionable insights through three simple ratings: Relative Value (RV), Relative Safety (RS), and Relative Timing (RT). Each is scored on a scale of 0.00-2.00, with 1.00 being average, simplifying your trading decisions.

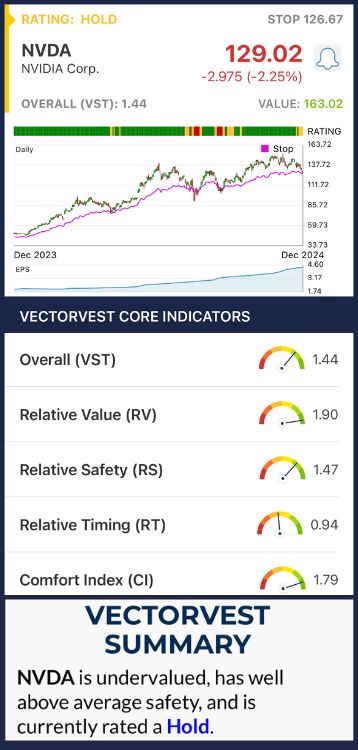

It gets even better—VectorVest provides a buy, sell, or hold recommendation based on the overall VST rating for any given stock. Here’s what we found for NVDA:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. As for NVDA, the RV rating of 1.90 is excellent.

- Excellent Safety: The RS rating is a risk indicator. It’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, and other factors. NVDA has an excellent RS rating of 1.47.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. NVDA has a fair RT rating of 0.94 right now

With an overall VST rating of 1.44, Nvidia is currently rated HOLD in the VectorVest system. While the stock boasts excellent safety and strong long-term growth potential, its weak timing reflects the recent pullback in price momentum.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks that are rising in price. NVDA currently demonstrates excellent safety and strong long-term upside potential, but weak timing has caused it to pull back, landing it in correction territory.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment