Micron Technology (MU) surged 6.8% Monday as anticipation builds for its upcoming fiscal Q1 earnings report, scheduled for release later this week. Despite analyst expectations of an earnings miss, optimism surrounding the memory chipmaker continues to grow.

Micron’s stock has already gained 32% year-to-date, outpacing broader market averages. Key drivers of this momentum include easing inventory challenges in the DRAM market and a $6.1 billion government investment to expand its U.S.-based memory chip facilities. With demand for chips expected to rebound, particularly in data centers, Micron is positioning itself as a leader in the memory sector.

But is now the right time to buy MU, or should investors remain cautious? Using VectorVest stock analysis, we found three compelling reasons to consider Micron today.

MU Shows Strong Upside Potential, Fair Safety, and Very Good Timing

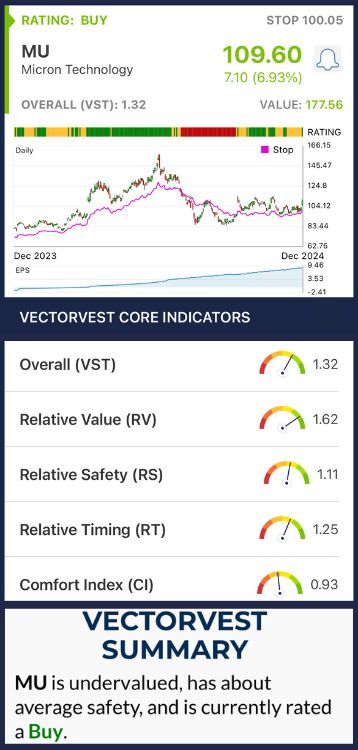

VectorVest is a proprietary stock rating system that takes complex technical data and fundamental insights and distills them into 3 simple ratings, giving you all the insights you need to make clear, calculated, emotionless decisions.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, which makes interpretation quick and easy.

It gets even better, though. You’re given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for MU, here’s what we’ve uncovered:

- Strong Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a much better indicator than the typical comparison of price to value alone. MU has a strong RV rating of 1.62 right now.

- Fair Safety: The RS rating is a risk indicator calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. While slightly above average, MU has a fair RS rating of 1.11.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s computed day over day, week over week, quarter over quarter, and year over year. MU has a very good RT rating of 1.25, reflecting its recent momentum.

The overall VST rating of 1.32 is very good for MU, and enough to earn the stock a BUY recommendation.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. MU surged over 6% ahead of its upcoming earnings, driven by optimism around easing DRAM inventory challenges and strong government investments. Despite analysts forecasting a potential earnings miss, the stock demonstrates strong upside potential, fair safety, and very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment