Intel (INTC) has been facing a tumultuous period, marked by the resignation of CEO Pat Gelsinger after a challenging tenure. Under Gelsinger’s leadership, the semiconductor giant has struggled to keep pace with competitors, particularly in the AI chip space, where Nvidia has surged ahead. This week, Intel announced that Gelsinger would be stepping down as CEO and from the company’s board, with David Zinsner and Michelle Johnston Holthaus appointed as interim co-CEOs.

Intel’s Struggles and the Changing of the Guard

Gelsinger’s resignation comes after a series of setbacks for Intel, including a 61% drop in stock value during his tenure. Once a dominant force in the semiconductor industry, Intel has been overtaken by Nvidia, which has cornered the market for AI chips. Despite efforts to rejuvenate the company, including a focus on state-of-the-art manufacturing and billions in federal funding, Intel has not been able to recover its leading position in the market.

The company’s recent financials reflect these struggles, including a $16.6 billion loss in the most recent quarter and significant layoffs as part of a $10 billion cost-saving initiative. The departure of Gelsinger marks a critical moment for Intel as the company faces mounting competition and the potential for further loss of market share, particularly in the burgeoning AI industry.

The Market Response and Outlook

Intel’s shares saw a slight rally, gaining about 2.6% in morning trading following the news of Gelsinger’s resignation. However, the stock has shed 42% of its value in the past year, and the company’s market capitalization continues to shrink as it faces increased competition from Nvidia, which recently replaced Intel on the Dow Jones Industrial Average.

The company’s new leadership team, under the co-CEOs Zinsner and Holthaus, will face the daunting task of trying to steer Intel back to growth. While the Biden administration has continued to support Intel through federal funding for chip manufacturing, it remains to be seen whether the company can turn things around and regain its position in the semiconductor industry.

INTC Has Fair Upside Potential, But Poor Safety and Fair Timing are Holding it Back

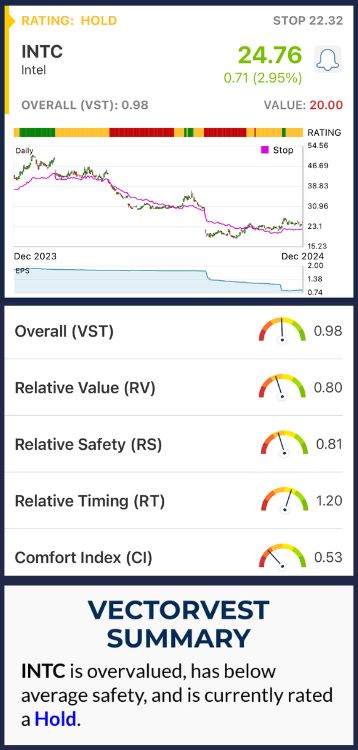

VectorVest is a proprietary stock rating system that simplifies stock analysis into three clear ratings, making it easier to make calculated investment decisions. The system has consistently outperformed the S&P 500 index over the last 20 years, delivering actionable insights based on relative value (RV), relative safety (RS), and relative timing (RT).

These ratings sit on a scale from 0.00-2.00, with 1.00 being the average, allowing for quick and easy interpretation. Additionally, VectorVest provides a buy, sell, or hold recommendation based on the overall VST rating for any stock. Here’s what we found for Intel (INTC):

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year forecast), AAA corporate bond rates, and risk. INTC has a fair RV rating of 0.80, suggesting slight undervaluation, but the stock's long-term growth potential is limited.

- Poor Safety: The RS rating assesses the company's financial consistency, debt-to-equity ratio, business longevity, and other factors. With an RS rating of 0.81, INTC’s financial stability and predictability are below average, indicating higher risk.

- Fair Timing: The RT rating measures the stock’s price momentum, looking at short-term price movements. INTC has a RT rating of 1.20, suggesting that, while the stock's momentum is currently stable, it’s neither strong nor weak, showing fair timing.

With an overall VST rating of 0.98, INTC’s stock shows a neutral outlook. This results in a HOLD recommendation, as its growth potential is hindered by poor safety and fair timing, preventing it from being a strong buy at this time.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks that are rising in price. INTC continues to struggle, down another 2% today, further adding to the losses it has faced over the past month and year. The company is grappling with numerous challenges, including intense competition and a shift in the chip market. Despite having some upside potential, INTC suffers from poor safety and fair timing, making it a risky investment at this time.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment