Amazon (AMZN) stock surged in after-hours trading on Thursday following a strong third-quarter earnings report that topped Wall Street’s expectations. The company’s results were driven by solid growth in its cloud and advertising businesses, which continue to be significant contributors to Amazon’s revenue growth.

Quarter Highlights

Amazon reported third-quarter revenue of $158.9 billion, marking an 11% year-over-year increase and exceeding the expected $157.3 billion, according to Visible Alpha. Earnings per share (EPS) also came in strong at $1.43, growing more than 50% and beating analyst forecasts by a comfortable margin. The results demonstrated Amazon’s ongoing ability to drive revenue growth and improve profitability, even amid challenges in the retail sector.

A key driver of Amazon’s performance was the robust growth in Amazon Web Services (AWS). The cloud computing division saw revenue climb 19% to $27.4 billion, roughly in line with expectations. This marks a return to high-teens growth for AWS, after slowing to the low teens in 2023. Amazon’s advertising segment also performed well, growing 19% to $14.3 billion, aligning with expectations and showing the strength of this rapidly expanding part of Amazon’s business.

Future Outlook and Spending

For the upcoming fourth quarter, Amazon has forecasted net sales to range from $181.5 billion to $188.5 billion. While this guidance is mostly in line with expectations, the midpoint sits just below Wall Street’s projection of $186.4 billion. Nevertheless, the forecast points to continued growth during what’s traditionally Amazon’s strongest quarter, fueled by the holiday season and Prime deals.

Amazon’s investment in capital expenditures (CapEx) increased by 5% year-over-year to $22.2 billion. Much of this spending is targeted at data center infrastructure as Amazon races to strengthen its AI capabilities and stay competitive with cloud giants Microsoft (MSFT) and Google parent Alphabet (GOOGL). These substantial investments underscore Amazon’s commitment to its cloud and AI divisions, which could pave the way for future growth.

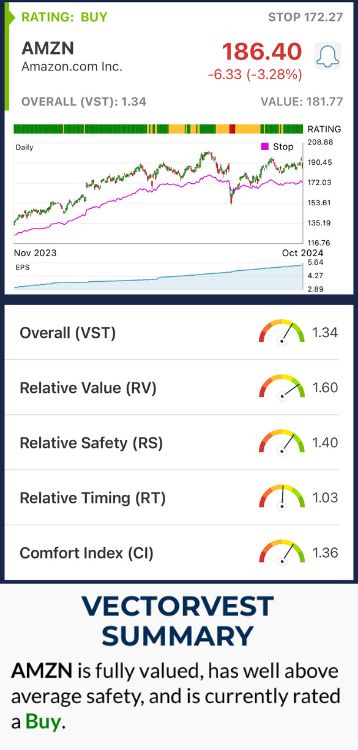

AMZN Has Excellent Upside Potential and Safety with Fair Timing

VectorVest has Amazon rated as a "Buy," reflecting the stock’s positive long-term potential, safety, and timing. Here’s a breakdown:

- Excellent Upside Potential: Amazon’s Relative Value (RV) of 1.60 indicates strong long-term price appreciation potential. This rating reflects Amazon’s future earnings potential compared to safe investment options, making it a compelling stock for long-term investors.

- Excellent Safety: Amazon also scores highly on Relative Safety (RS), with a rating of 1.40, suggesting reliable financial performance and a solid track record. This makes AMZN a stable investment in a sometimes volatile tech sector.

- Fair Timing: Amazon’s Relative Timing (RT) of 1.03 suggests the stock’s price trend is relatively steady. Despite some recent fluctuations, Amazon’s fair timing rating indicates a stable trend that could offer investors a smoother ride.

The overall VectorVest VST score for AMZN is 1.34, a very good rating. With Amazon’s long-term potential, safety, and current price trend, it’s a solid choice for those seeking to benefit from its growth in cloud computing and advertising.

Bottom Line

Amazon’s strong Q3 results highlight its resilience and growth in cloud computing and advertising, two high-margin segments that could continue fueling its growth. Despite increased spending, Amazon’s strategy to enhance its infrastructure and AI capabilities reflects its ambition to stay competitive. With VectorVest’s "Buy" recommendation, investors may want to consider this recent dip as an opportunity to build or expand their position in AMZN.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Amazon delivered solid Q3 results, backed by strong growth in its cloud and advertising divisions. While some investors may be cautious about the increased spending, the stock continues to show excellent upside potential and safety with fair timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment