Advanced Micro Devices (AMD) is down more than 9% Wednesday morning after the company’s third-quarter earnings results were released yesterday afternoon.

The semiconductor manufacturer showed strong performance in its data center segment specifically, which saw a massive 122% growth from this time last year. It helped push total revenue 18% higher year-over-year to $6.82 billion.

Earnings per share came in at $0.92, right in line with the analyst consensus. Experts were expecting just $6.71 billion in revenue for the quarter.

Another strength for the quarter was its client segment, which consists of PC processors among other products. This part of the business grew 29% year over year to just under $2 billion.

But, there were underperformers elsewhere in the company’s business. Its gaming segment was down 69% while the embedded segment fell 25%.

Still, AMD Chair and CEO Dr. Lisa Su says the performance in Q3 was strong, indicating increasing demand for its Ryzen PC processors. Su also pointed to the EPYC and Instinct data center products as a catalyst for the third quarter results.

The company is optimistic about the road ahead, with great potential in data center, client, and embedded business segments. Customers aren’t going to be content with current capabilities and will continue to upgrade for more compute where possible.

On that note, AMD disclosed its guidance for the fourth quarter – revenue should come in between $7.2 billion and $7.8 billion. The consensus estimate is pegged for $7.55, so the company will need to come in above the midpoint of that range to avoid an earnings miss.

The stock had rallied 8% over the past week heading into the news but fell sharply – now sitting 2% lower over the past 7 days. It’s been an up-and-down year for AMD, which is up 4% through 2024 thus far, falling short of its peers like NVDA and TSM.

So why is the stock tumbling, and where does this leave investors? We’ve taken a closer look at this situation in the VectorVest stock analysis software and found 3 things you need to know.

AMD Still Has Excellent Upside Potential and Safety With Fair Timing

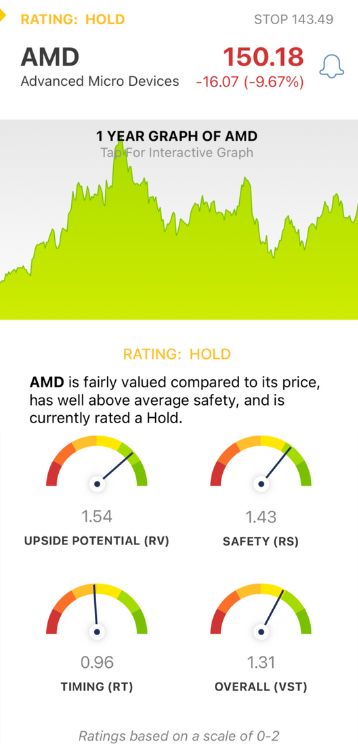

VectorVest saves you time and stress while empowering you to win more trades. It gives you all the information you need to make calculated, emotionless investment decisions in just 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average for effortless interpretation. Better yet, you get a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for AMD, here’s what we uncovered:

- Excellent Upside Potential: The RV rating is a much better indicator than the typical comparison of price to value alone. It compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. The RV rating of 1.54 is excellent for AMD, and the stock is fairly valued at its current price.

- Excellent Safety: The RS rating assesses a stock’s risk profile. It takes into account the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.43 is excellent for AMD as well.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year to paint the full picture for investors. The RT rating of 0.96 for AMD is just below the average but deemed fair nonetheless.

The overall VST rating of 1.31 is very good for AMD, and the stock is currently rated a hold.

But if you’re a current investor or trying to find an opportunity to trade this stock, you’re in luck. We’ve put together a more in-depth free stock analysis for you - take a closer look and set yourself up for success today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. AMD delivered on both the top and bottom lines in Q3 fueled by growth in key business segments, yet, the stock is tumbling today in the wake of the news. Still, it has excellent upside potential and safety with fair timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment