Shares of Mcdonald’s Corp. (MCD) have started the road to recovery Monday morning after losing roughly 7% over the past few days. The stock is up more than 1% today as many saw the dip as a buying opportunity.

The fast food chain is under fire amidst concerns that its popular Quarter Pounder burgers have exposed patrons to E. coli bacteria. A Centers for Disease Control (CDC) report found that 49 people across 10 states had fallen ill from the burgers, one of whom has since passed away.

However, the story is rapidly developing and that number could climb higher as the CDC updates its findings. In the meantime, McDonald’s has removed the quarter pounder from the menu in regions at risk.

It’s clear there will be consequences from this, so why are speculators running to buy MCD today? This story mirrors the one we saw with Chipotle a while back, in which investors brought in impressive returns by buying the stock after it plunged on its own E. coli concerns.

The McDonald’s situation is quite a bit different, though. For one, the company has already identified exactly what caused the outbreak and has isolated it. That never happened with Chipotle.

Another distinction is that Chipotle doesn’t offer a dividend, which caused a more widespread sell-off when the Mexican grill was put under fire years back. McDonald’s does offer a dividend, and an impressive one at that – so investors will be more patient with the stock.

Experts are under the impression that MCD won’t be hit the same way CMG was. This is where the intrigue surrounding the stock comes into play.

Is it going to pick up momentum today and continue climbing? Or has it hit a valuation wall and is poised to reverse? MCD is up 17% in the past 3 months, after all. We’ve taken a closer look in the VectorVest stock software and found 3 things you need to know before buying/selling MCD.

MCD Has Fair Upside Potential and Safety With Good Timing

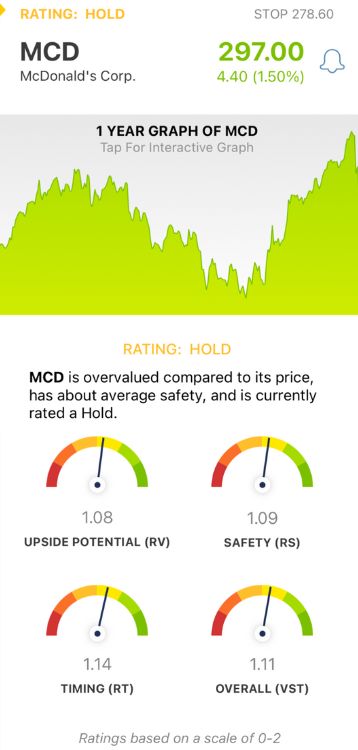

VectorVest simplifies your trading strategy by telling you what to buy, when to buy it, and when to sell it. The best part is it does all this through 3 proprietary stock ratings: relative value (RV), relative safety (RS), and relative timing (RT). This saves time and stress while boosting returns.

Each rating sits on an easy-to-interpret scale of 0.00-2.00 with 1.00 being the average. You’re even offered a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for MCD, here’s what we uncovered for you:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. MCD has a fair RV rating of 1.08.

- Fair Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.09 is also fair for MCD.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. Despite the poor performance from the end of last week, MCD still has a good RT rating of 1.14.

The overall VST rating of 1.11 is good for MCD but not enough to earn it a buy right now. The stock is rated a HOLD in the VectorVest system. Take a look yourself so that you’re ready to capitalize when the time is right to buy MCD - a free stock analysis is just a click away!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. MCD fell nearly 7% last week as an E. coli outbreak spooked the market. The stock has begun climbing back in the right direction today, as the issue looks to be contained. MCD still has fair upside potential and safety with good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment