Shares of Super Micro Computer (SMCI) soared yesterday and were on pace for their best trading day in more than 7 months. The stock ended up gaining around 15%, although it started to come back down to earth in Tuesday’s trading session. It’s lost 5% of its gains so far today.

This all came after the company announced an innovative new solution it is working on that relies on “coolant distribution units” for liquid cooling alongside cooling towers and more.

These CDUs align perfectly with the needs of artificial intelligence workloads since they have such heavy power requirements. Server makers have been working towards a solution of this caliber that can protect expensive hardware from the consequences of overheating.

But what are the actual implications of such a cooling system? Super Micro went on to say that its technology can bring power costs down along with Day 0 hardware-acquisition and data-center cooling infrastructure costs. In other words, it’s well worth the investment.

The company’s research and development efforts found that its direct liquid cooling technology exceeds the capabilities of traditional air cooling, with up to 40% savings on electricity costs while taking up 80% less space.

In other news for Super Micro, the company is currently sending out over 100,000 graphic processing units (GPUs) each quarter. Things look to be ramping up, which comes at the perfect time for investors who have been patiently waiting for a turnaround over the past few months.

The company, and the stock as a result, have struggled amidst deteriorating margins as stiff competition has led to more aggressive pricing. There are also concerns among short-sellers surrounding the company’s August accounting report.

Although SMCI has gained 13% in the past month and remains up 61% through 2024 thus far, it’s still down 48% over the past three months. So, where does that leave current or prospective investors?

We’ve taken a look at SMCI through the VectorVest stock analysis software and found 3 things you need to weigh before doing anything else today.

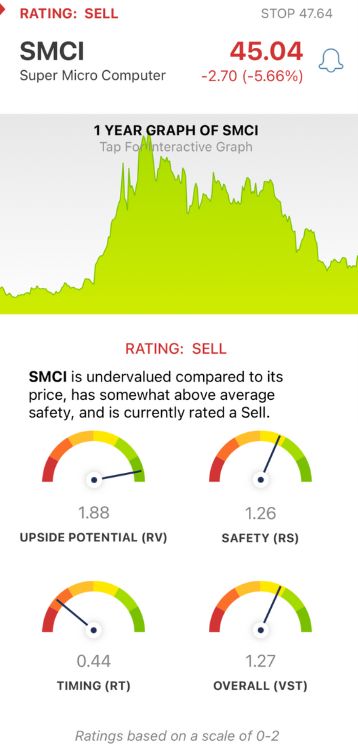

SMCI May Have Excellent Upside Potential and Very Good Safety, But Very Poor Timing Means it’s Time to Sell

VectorVest is a proprietary stock rating system designed to save you time and stress by empowering you to win more trades with less work. It does this by delivering all the clear, actionable insights you need to make calculated, emotionless decisions in 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes for quick and easy interpretation. But, it gets even better.

You’re also offered a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for SMCI:

- Excellent Upside Potential: The RV rating is a far superior indicator than the typical comparison of price to value alone. It goes further, comparing a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. The RV rating of 1.88 is excellent for SMCI. The stock is undervalued, with a current value of $102.40.

- Very Good Safety: The RS rating is a risk indicator. It’s derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.26 is very good for SMCI.

- Very Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. Even though the stock rallied yesterday and still sits more than 60% higher on the year, the current RT rating of 0.44 is very poor for SMCI.

The overall VST rating of 1.27 is very good for SMCI, but the stock is still rated a SELL in the VectorVest system, and will likely remain so until a more positive, meaningful price trend forms.

But, there’s a bit more to this story than meets the eye - so dig deeper with a free stock analysis at VectorVest today, whether you’re currently invested in SMCI or trying to trade the stock. Transform your approach to analysis today and win more trades with less work!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. SMCI announced plans for its new liquid cooling system that will save energy and space, delivering a tangible ROI for its customers. Although the stock itself has excellent upside potential and very good safety, very poor timing is currently holding it back.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment