Palantir Technologies (PLTR) has been on a torrent charge through 2024 thus far, up more than 133% – and up 156% since this time last year. While the industry has a whole has boomed, this particular stock has outpaced its peers by nearly 28%.

The question is, should you still buy PLTR today, or did you miss the opportunity? There are quite a few moving pieces to consider, including the company’s positioning in AI.

While the focus has been on chipmakers like NVDA, companies like Palantir have taken measures to incorporate AI adoption across their offerings.

Sectors that rely on comprehensive data integration – defense, healthcare, finance, intelligence, and more – are benefiting from Palantir’s AI Platform, which combines its Foundry and Gotham platforms.

We saw the effects of this strategy reaping benefits for the business in Q2 of this year, in which sales grew 23% thanks to a surge in demand for these types of AI solutions. US commercial revenues in particular were up 55%.

But AI isn’t just helping the company grow its top line – the bottom line is booming, too. Net income exploded 88% year over year while adjusted operating margin was up 1,200 basis points.

With no debt and $4 billion in cash, Palantir is positioned to continue investing in growth opportunities. Its strong balance sheet is just one of many reasons it was added to the S&P 500 index last month. It’s impossible to continue overlooking PLTR.

The prospects for Q3 look promising, too. Estimates are for 9 cents earnings per share, which would be nearly 29% growth YoY. Sales are expected to climb 26% as well. For the full year, Palantir is expected to deliver 44% and 24.2% earnings and sales growth respectively.

PLTR is up nearly 1% today again, looking to close the week strong with a more than 7% gain. So, where does this leave you – is there still room to squeeze out some profit by trading this stock? We’ve taken a look at the VectorVest stock software and found 3 more things to consider.

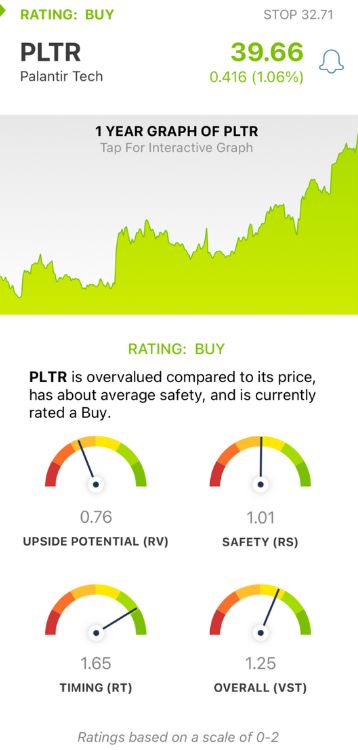

PLTR Has Poor Upside Potential, But Fair Safety and Excellent Timing Make it a BUY

VectorVest is a proprietary stock rating system that distills complex technical and fundamental data into clear, actionable insights. It helps you win more trades with less work and stress.

You’re given everything you need to know to make calculated, emotionless investment decisions in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on an intuitive scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. Better yet, you’re given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s the shakedown for PLTR:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. PLTR has a poor RV rating of 0.76, as there is concern about how much higher the stock can really go.

- Fair Safety: The RS rating is a risk indicator. It’s derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.01 is fair for PLTR.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. PLTR has an excellent RT rating of 1.65, reflecting its strong performance in both the short and long term.

The overall VST rating of 1.25 is good for PLTR and the stock is still rated a buy right now. But before you make your next move, take a moment to review this free stock analysis and set yourself up for a smooth, profitable trade with the help of VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PLTR has surged over the past year, but it’s hard to envision this stock slowing down any time soon given the company’s positioning in its industry. It may have poor upside potential, but fair safety and excellent timing earn it a BUY recommendation.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment