Salesforce (CRM) reported second-quarter earnings and revenue that came in ahead of analyst expectations thanks to a surge in bookings and early renewals for key clients. Here’s how the company performed compared to the consensus:

- Earnings: $2.56/share compared to the estimate of $2.35/share.

- Revenue: $9.3 billion compared to the estimate of $9.2 billion.

Revenue showed 8% growth year over year while the company’s profit widened by 20% year over year and 1.9% quarter over quarter. Operating cash flow climbed 10% to $890 million, while free cash flow was up 20% to $760 million.

In what could be her last quarter earnings commentary with Salesforce, CFO Amy Weaver said that the company showed disciplined, profitable growth with operating margins as high as they’ve ever been. Weaver announced her intention to resign, but she’ll await a replacement before departing.

Salesforce relies on a key metric known as “current remaining performance obligation,” or cRPO. This merges new bookings for a given period with the remaining future revenue from open subscriptions.

The guidance for cRPO was 9% growth for the July quarter, but the company slightly outperformed as it actually came in at 10%, or $26.5 billion.

Earnings guidance for the remainder of the year got a lift as well. The revenue range now calls for $37.7 billion to $38 billion while the company sees cash profit falling between $10.03 and $10.11 a share. Analysts are calling for $37.8 billion in revenue and $9.89 a share in profit.

CRM had climbed as much as 5% heading into today but has remained flat so far this morning. The stock is stagnant through 2024. So, where does that leave investors who own CRM or are looking for an opportunity to trade it?

We’ve dug a bit deeper into the VectorVest stock forecasting software and found 3 things you need to see if you’re interested in buying CRM.

CRM Has Excellent Upside Potential and Safety With Fair Timing

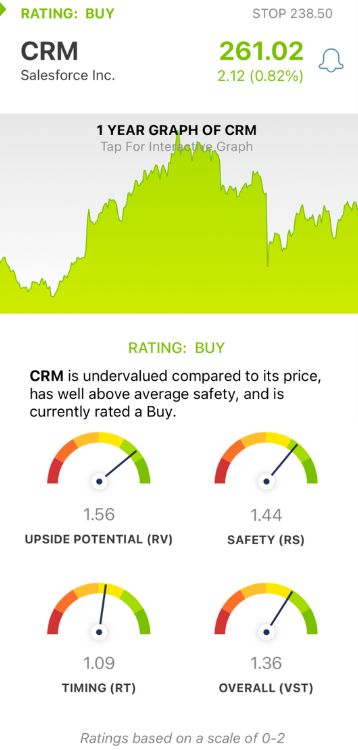

VectorVest simplifies your trading strategy by delivering clear, actionable insights in just 3 ratings to help you win more trades with less work and stress. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy, but it gets even better. You’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s what we found for CRM:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. CRM has an excellent RV rating of 1.56. Plus, the stock is undervalued. Current value is $292/share.

- Excellent Safety: The RS rating is a risk indicator. It’s derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.44 is also excellent for CRM.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.09 is fair for CRM.

The overall VST rating of 1.36 is very good for CRM and enough to earn the stock a BUY recommendation in the VectorVest system. But before you make your next move, take a closer look at this opportunity with a free stock analysis so you can fully capitalize!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. CRM delivered an earnings beat on the top and bottom lines for the second quarter while reporting record profits, and lifted its guidance for the year as well. The stock itself has excellent upside potential and safety with fair timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment