It’s no secret that Nvidia Corporation (NVDA) has been the center of attention since the AI boom began a few years ago. It’s surged nearly 3,000% in the past 5 years and until recently, showed no signs of slowing down.

Even after a few slight hiccups throughout the summer thus far, it’s always responded well and recovered any losses, and then some. It currently sits just 7% off its all-time high. With Q2 earnings roughly 24 hours away, there’s reason to believe it could push past that price.

This is potentially the most important quarterly earnings report the company has delivered yet, as it could make or break not just the NVDA rally we’ve seen over the past month (up nearly 11%), but the stock market as a whole.

EMJ Capital analyst Eric Jackson spoke to this, saying NVDA is the most important stock in the world right now for this exact reason. The market has begun looking at the company as a bellwether for the AI industry as a whole. Any uncertainty or drop in demand could spell disaster.

Jackson is bullish on Q2 earnings tomorrow and expects to be pleasantly surprised. But, the bar is extremely high for Nvidia after seeing more than 3x growth in revenue over the past three quarters.

Analysts are expecting to see triple-digit revenue growth for the fourth quarter in a row with the consensus calling for $28.7 billion. Looking further ahead to the third quarter (set to release in October), the consensus calls for $31.7 billion – just a 75% growth.

Major clients have been spurring up optimism for Nvidia earnings as well, as the likes of Google and Meta are discussing their intentions to continue building out infrastructure.

There is also suspense surrounding the next-generation AI chips Nvidia has been working on – the Blackwell series. Our last update sparked concern about production delays, with the first shipments now forecasted for early 2025.

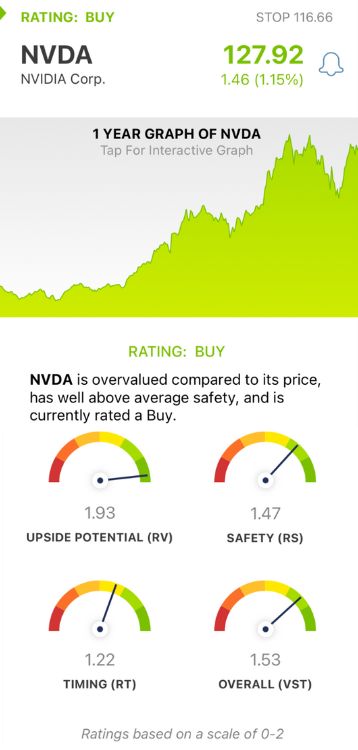

Just a few weeks ago we took a look at NVDA’s recovery through the first half of August, in which it rallied 25% in a single week, outpacing its peers. At the time we saw the stock had a BUY recommendation in the VectorVest system, as it sat at just under $122/share. It’s just under $128/share today.

So, where does NVDA sit heading into Q2 earnings tomorrow after the bell – is now a good time to buy this stock still? We’ve looked at the VectorVest stocks software and found 3 reasons to bolster your position if you haven’t already.

NVDA Has Excellent Upside Potential and Safety With Good Timing

VectorVest is a proprietary stock rating system that delivers clear, actionable insights in just 3 simple ratings, helping you win more trades with less time and stress. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. It gets even better, though. You’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s what we found for NVDA:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator to the typical comparison of price to value alone. NVDA has an excellent RV rating of 1.93.

- Excellent Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. NVDA has an excellent RS rating of 1.47.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.22 is good for NVDA.

The overall VST rating of 1.53 is excellent and earns the stock a BUY recommendation still. Don’t miss out on this opportunity to capitalize on NVDA - get a free stock analysis at VectorVest today and set yourself up for success!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. NVDA has all eyes on its Q2 earnings report set to release tomorrow after the bell, with high expectations - but the company has proven time and time again that it can deliver. The stock itself has excellent upside potential and safety with good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment