Amazon (AMZN) reported second-quarter earnings and spoke on its growing AI business, which was enough for some analysts to stand by their price targets. But as the stock continues to fall, VectorVest sees reason to consider selling it today.

The online marketplace reported revenue of $147.98 billion, just short of the $148.56 billion consensus but still up 10% year over year. Revenue from AWS specifically was up 19% at $26.3 billion, which was enough to satisfy the $26 billion expectation.

Earnings of $1.26 per share easily surpassed the analyst estimate of just $1.03 per share. This was about double the earnings reported in 2023 as the company’s profitability efforts are coming to fruition.

The focus of the earnings call was AI – more specifically, Amazon’s plans to begin developing its own chips in an effort to bring prices down. The company currently sources from Nvidia, which produces notoriously expensive products.

CEO Andy Jassy acknowledged the company’s relationship with Nvidia but referenced that customers are looking for more affordable solutions. Jassy mentioned the company is expecting to see its second iteration of its own chips later this year.

Amazon’s AI business has already achieved a multi-billion dollar revenue run rate, which is impressive considering the timeline. Now it’s just a matter of making the segment more profitable.

AMZN has plummeted over the past few weeks leading into Q2 earnings, down nearly 20% in the past 30 days and just about 5% so far today. While the stock is still up 6% through 2024, it’s time to assess its place in your portfolio.

We’ve taken a look at AMZN through the VectorVest stock software and found a few things current investors or prospective traders need to see.

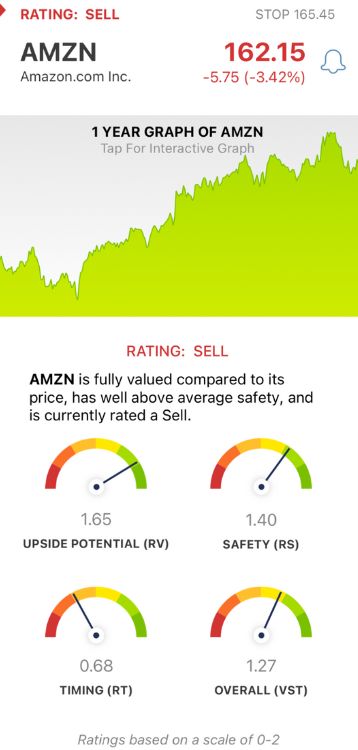

AMZN Still Has Excellent Upside Potential and Safety, But Poor Timing is Weighing the Stock Down

VectorVest is a proprietary stock rating system designed to save you time and stress while helping you win more trades.

You’re given all the insights you need to make calculated, emotionless investment decisions in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy. You’re even offered a buy, sell, or hold recommendation for any given stock at any given time based on the stock’s overall VST rating. As for AMZN, here’s what we found:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This makes for a far superior indicator to the typical comparison of price to value alone. AMZN has an excellent RV rating of 1.65.

- Excellent Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.40 is also excellent for AMZN.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. The RT rating of 0.68 is poor for AMZN and reflects the stock’s recent performance.

The overall VST rating of 1.27 is actually very good for AMZN, but the stock is still rated a sell amidst the downward price pressure we’ve seen over the past few weeks.

Before you make your next move, take a moment to view this free stock analysis for the full scoop on AMZN. Transform your trading strategy for the better with VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. AMZN delivered solid earnings and revenue in the second quarter and has investors excited about its AI potential. However, the stock continues to fall lower and lower. It may have excellent upside potential and safety, but the timing is poor right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment