Heineken (HEINY) has fallen more than 10% so far Monday morning after the company’s latest earnings results left much to be desired, specifically from a profit perspective.

While the forecast called for an operating profit growth rate of 13.2%, Heineken reported just 12.5% growth. As a result, the Dutch brewing manufacturer took a net loss in the first half of 2024, which worked out to 95 million Euros ($103 million).

Much of this is the result of an 874 million euro non-cash impairment related to its investment in CR Beer – a Chinese brewing company. It’s worth noting that this was merely a result of the stock price falling, not the company’s actual performance.

Despite the profit miss, Heineken CEO Dolf van den Brink expressed satisfaction with the company’s first-half performance. He referenced balanced and broad-based volume growth across the world along with a 5% increase in premium products.

A big win was increased market share in low and no-alcohol beer sales. Heineken 0.0 saw 14% growth in sales, and van den Brink says this segment is increasingly important for the company.

Still, the gap between company performance and analyst expectations is wide enough to cause concern. The biggest issue holding Heineken back is in Europe, where profit grew just 0.2% compared to the 15.1% experts were anticipating. High advertising costs in a crowded market cut into profits in this region.

The company’s updated forecast for the full-year profit growth is now 4% to 8%, slightly below the original outlook.

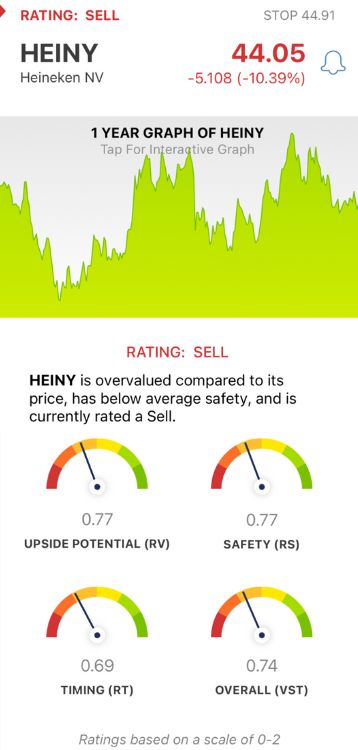

HEINY is now down more than 11% through the first half of the year. We’ve taken a closer look at this situation in the VectorVest stock analysis software and found 3 things you need to see if you’re currently invested in this stock or looking for an opportunity to trade it.

HEINY Has Poor Upside Potential, Safety, and Timing

The VectorVest system saves you time and stress while empowering you to win more trades with less work. It does this by giving you clear, actionable insights in just 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. Better yet, you’re given a buy, sell, or hold recommendation based on a stock’s overall VST rating at any given time. As for HEINY, here’s what we uncovered:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This makes it a far superior indicator than the typical comparison of price to value alone. The RV rating of 0.77 is poor for HEINY.

- Poor Safety: The RS rating is a risk indicator computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating also works out to 0.77 for HEINY, which is poor.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 0.69 is poor for HEINY as well.

The overall VST rating of 0.74 is poor for HEINY and the stock is rated a SELL right now. If you want to get the full scoop before you make your next move, though, take a moment to dig into this free stock analysis at VectorVest and transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. HEINY reported a disappointing profit growth miss for the first half of 2024, sending shares 10% lower Monday Morning. The stock itself has poor upside potential, safety, and timing, earning it a SELL in the VectorVest system.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment