American Airlines (AAL) reported second-quarter earnings that may have outperformed the Wall Street consensus but painted a concerning narrative for the sales strategy the company has gone all in on.

Adjusted earnings per share came in at $1.09 per share, narrowly surpassing the analyst consensus of $1.05. However, revenue fell short at $14.33 billion compared to the outlook of $14.36 billion.

CEO Robert Isom spoke to this disappointing performance, saying that although the company is equipped with the necessary resources to deliver results, it fell short.

Isom referenced the prior sales and distribution strategy as a key issue and said that an imbalance of domestic supply and demand also played a part.

American has taken “swift and aggressive action” to rethink its sales and distribution strategy, undoing direct-to-consumer sales policies that ultimately backfired. The airliner has taken quite a bit of heat from customers and travel agents alike.

The only silver lining is that American isn’t the only airliner struggling. Southwest (LUV) just reported its own profit woes, matching the 46% dip American recorded.

The Fort Worth-Texas airliner said that it’s now forecasting as much as a 4.5% decrease in revenue with a more modest outlook for travel demand.

It also narrowed its outlook for the full year, now expecting just $0.70 to $1.30 per share. The previous guidance called for $2.25 to $3.25. Analysts were expecting at least $1.10 to $2.60 per share.

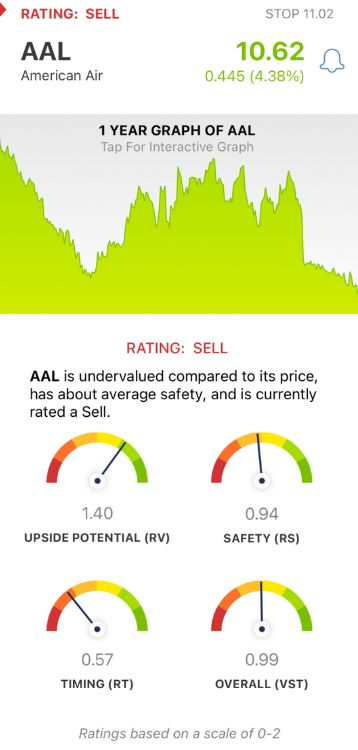

AAL dipped as much as 8% in pre-market trading, but since the bell sounded, the stock cruised higher to a nearly 5% gain on the day. It’s still down 25% over the past 3 months, though.

We’ve taken a closer look at the situation through the VectorVest stock analysis software and see reasons to consider selling AAL today…

AAL May Have Excellent Upside Potential and Fair Safety, But Poor Timing is Holding it Back

VectorVest helps you make more confident, calculated investment decisions through a proprietary stock rating system that distills complex technical data into clear, actionable insights.

You’re given everything you need to know in just 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy.

The system even issues a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for AAL, here’s what you need to know:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. This makes it a far superior indicator than the typical comparison of price to value alone. AAL has an excellent RV rating of 1.40.

- Fair Safety: The RS rating is a risk indicator. It’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. AAL has a fair RS rating of 0.94.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. This is what investors need to be worried about - AAL has a poor RT rating of 0.57.

The overall VST rating is just below the average at 0.99 and considered fair. However, AAL is rated a SELL right now as it continues to fall lower and lower.

If you want to learn more about this stock before making your next move, you’re in luck. A free stock analysis is just a click away at VectorVest ready to help you transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. AAL reported disappointing Q2 results as its sales strategy isn’t panning out. Profits are down 46%. The stock itself has excellent upside potential with fair safety, but the timing is poor right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment