The market came under pressure this week following Fed Chair Jerome Powell’s comments about inflation that were less than enthusiastic. While speaking at a policy forum focused on US-Canada economic relations, Powell articulated that the first quarter’s sticky inflation data means market-rate cuts will happen later than initially hoped. The Fed’s benchmark interest rate is the highest it’s been in 23 years at 5.25%-5.5%, and Powell confirmed the market’s negative sentiment that rate cuts and pushed the indexes into the red. Let’s dive into the market’s response, Powell’s comments, and what analysts anticipate from the Fed.

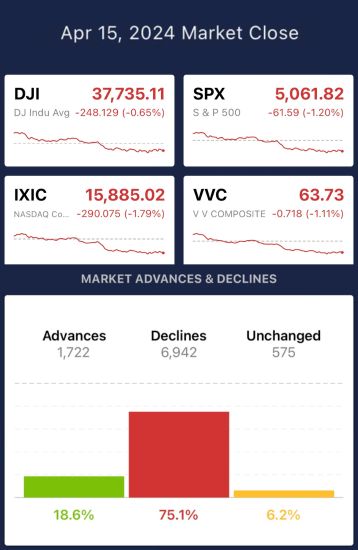

Monday’s close was in the red, with the Dow down 248 basis points (-0.65%), the S&P 500 down 61 basis points (-1.2%), and decliners leading advancers at 75.1%.

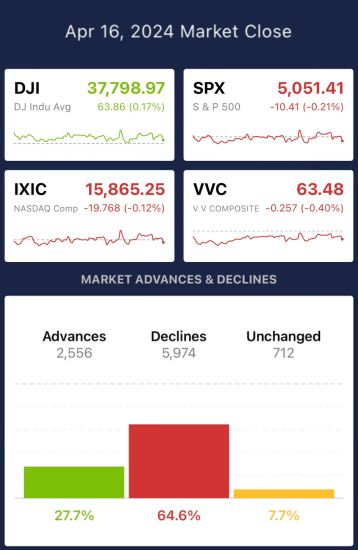

Tuesday’s close was mixed with the Dow up 63 basis points (+0.17%), the S&P 500 down 10 basis points (-0.21%), and decliners maintaining their lead at 64.6%.

An hour into today’s trading session, markets begin to reverse declines, with the Dow up 66 basis points (+0.18%), the S&P 500 up 8 basis points (+0.16%), and advancers leading decliners at 53.6%.

What did Powell say?

The hot CPI data reported last week, combined with the highest benchmark rate in 23 years (5.25%-5.5%), means every word Fed Chair Jerome Powell speaks is intently listened to by investors. Although the most important figure at the Federal Reserve, Powell’s comments are supported by other central bank officials’ recent speeches. Powell’s significant comments include;

- “The recent data have clearly not given us greater confidence, and instead indicate that it’s likely to take longer than expected to achieve that confidence.”

- “More recent data shows solid growth and continued strength in the labor market, but also a lack of further progress so far this year on returning to our 2% inflation goal.”

- "Right now, given the strength of the labor market and progress on inflation so far, it's appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us."

- “We can maintain the current level of restriction for as long as needed.”

In summary, the data didn’t support a rate cut, more progress is needed to achieve a 2% inflation goal, and maintaining restrictive policy will allow the market to adjust as appropriate.

How will it impact the market

The news that rates will remain unchanged for the next few FOMC meetings settled in before Powell’s speech. After multiple central bank speakers' reactions to the inflation data, it is no surprise Powell articulated a similar stance as his fellow FOMC members, meaning the market impact will be minimal because it’s old news. However, it leaves room to anticipate what to expect from future commentary. The market will be especially sensitive if central bank officials comment on monetary policy by saying the following things;

- Weakening of the job market

- Rates need to be raised

- Rates should be cut

Any new forward-looking commentary from the Fed will change the game for investors because it will predict when rate cuts will or will not happen. So although this recent speech at the policy forum didn’t change the game, there’s no doubt it will continue to shift the market.

How VectorVest Helps

The continual evaluation of data and monitoring of Federal speakers causes anxiety in the market. How it will affect stocks and the overall market remains anyone's guess. However, staying informed is crucial during such times. You can do that with VectorVest! Investors who feel lost in the uncertainty can navigate by making informed investment decisions based on solid research, precise analysis, and clear recommendations. These recommendations include potential investments and buy timing while also keeping a thumb on the movements of the overall market.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment